ICBC has announced some major changes to our car insurance system in British Columbia that take effect on September 1, 2019. At Acera Insurance, we’re here to help you understand the changes, and how they affect you.

Currently, ICBC calculates the insurance premiums you pay based on the Claim-Rated Scale (which calculates discounts up to 43% based on 20 years of claimless driving), the make/model/year of your car, and your territory (where you drive your car). Starting September 1, 2019, driving experience and crash history will have a bigger impact than they do today in determining what you pay.

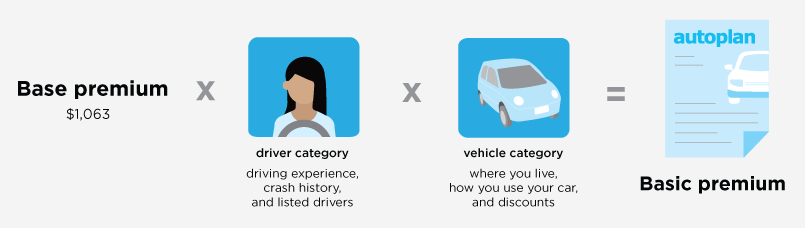

Under the new model, ICBC will calculate your Basic insurance premium starting with a base of $1,063. This amount will increase or decrease depending on factors such as your driving history, other listed drivers, location, usage of the vehicle and applicable discounts.

Listing Drivers

When you renew your car insurance, ICBC will ask you to list all individuals who drive your vehicle. The driving experience and crash history of your listed drivers will also play a factor in calculating what you pay.

Video: How ICBC Calculates Basic Premiums

Try this interactive tool on ICBC’s website that will provide you an estimate of your Basic insurance premium.

FAQs

You’ll be asked to list anyone who drives your car such as household members, employees, learners and others who use your car. If one of the listed drivers causes a crash in your car, the at-fault driver will be held accountable for the crash.

You can add or remove drivers any time and it doesn’t cost anything. Adding drivers won’t necessarily change your premium – it will depend on many factors including the driving experience and crash history of all the listed drivers.

The majority (75%) of your Basic insurance premium will be based on the principal driver (the person who will drive the vehicle the most). Of the other listed drivers, the one with the highest level of risk will make up the remaining 25%.

However, if the listed driver is lower-risk than the principal driver, there will only be a reduction in the premium if that listed driver is a household member or employee. This will help prevent people from adding lower-risk drivers to their policies simply to artificially reduce their premiums. Adding drivers won’t necessarily increase your premium. It will depend on various factors, such as each listed driver’s experience and crash history.

If you would like the flexibility to be able to lend your car occasionally to a driver not listed on your policy, Unlisted Driver Protection can provide peace of mind. This new protection allows for unanticipated drivers to drive your vehicle occasionally. Occasional use is defined as up to 12 days in a year, per driver.

Previously it had been announced that this protection would start at $50 per year. Now, this additional protection won’t have to be purchased.*

If you don’t have Unlisted Driver Protection, you could face a one-time financial consequence if that driver causes a crash in your car. This will depend on the driving experience and crash history of the unlisted driver.

Unlisted Driver Protection will not protect you from this financial consequence, though, if any of these people cause a crash in your car, as they should be listed on your policy:

- Household members

- Employees

- Anyone who has driven any of your vehicles for more than 12 days in the last 12 months

Anyone who has caused a crash in any of your vehicles in the last five years (from September 1, 2019) and unlicensed drivers are also excluded from this protection.

* If an unlisted driver causes a crash in your car, Unlisted Driver Protection will then cost $50 annually (one fee, not per driver) and will increase if there are more crashes by unlisted drivers.

If you don’t have Unlisted Driver Protection or if it doesn’t apply (for example, the unlisted driver is a household member), you may face a one-time financial consequence.

There will be exemptions for extraordinary situations, such as when an unlisted driver uses your vehicle for a medical emergency. Mechanics and valets who may drive your car are covered by their own policy.

Although the Unlisted Driver Protection won’t need to be purchased, once an unlisted driver causes a crash in your car, this protection will cost $50 annually. If there are more crashes by unlisted drivers using your car, the cost of the protection will increase.

Yes, ICBC will forgive one crash after 20 years of driving experience, provided you have been crash-free for the last 10.

Currently, if you’ve been found responsible (at fault) for a crash that doesn’t involve injuries or costly vehicle damage, you could repay the cost of the claim to ICBC so it won’t affect your insurance premium. However, this allows some drivers to mask the true risk they represent. So, starting September 1, claim repayment is only possible if the claim amount is $2,000 or less. However, customers have until August 31, 2020, to decide whether to repay a previous claim (claims between March 1, 2017 and August 31, 2019), even if it has already affected their premium and regardless of the cost of the claim. This helps ensure you have enough information and time to make an informed decision about whether to repay a claim or not and how it will affect your future insurance costs.

Generally, drivers with more years of driving experience and no at-fault crashes will see greater discounts. You will be able to receive Basic insurance discounts for up to 40 years of driving experience, up from the current nine years of crash-free driving.

As for inexperienced drivers, currently their Basic insurance premiums are significantly discounted. ICBC will continue to offer them discounted premiums, however, these discounts will be reduced if they cause a crash, and eliminated if they cause a second one within the five-year scan period.

New B.C. residents already receive driving experience credit upon starting to drive in B.C. That credit will increase from a maximum of eight years to a maximum of 15. However, their premiums will reflect the additional risk they pose during their first three years driving in B.C.

New residents will no longer be asked to provide previous insurance documentation. However, new residents who get their B.C. driver’s licence after September 1, 2019 will need to prove their driver’s licence history to be eligible for up to 15 years of driving experience credit.

Yes, if a learner driver will be using your car, you should list them and a new additional premium will apply. The learner premium recognizes the risk that a learner driver represents and helps cover the costs of crashes caused by learners. The learner premium will range from $130 to $230 per year, depending on where you live. You don’t need to pay the premium for each learner – it is one cost to cover all learners using your car.

For learner drivers, time spent in the learner stage will not count towards their driving experience, and crashes caused by learners will not go on their driving record either.

There are no changes to the current discount for qualifying persons with disabilities.

Seniors will continue to receive a Basic insurance discount and will now benefit from more years of driving experience being considered – up to 40 years from the current nine years of crash-free driving. However, their discount will be reduced if they cause a crash and eliminated if they cause a second crash within the ten-year scan period.

There are no changes to the current discount for qualifying persons with disabilities.

Seniors will continue to receive a Basic insurance discount and will now benefit from more years of driving experience being considered – up to 40 years from the current nine years of crash-free driving. However, their discount will be reduced if they cause a crash and eliminated if they cause a second crash within the ten-year scan period.

Yes, ICBC is introducing changes to make premiums for Optional coverages align with the changes being made to the Basic rate model to make sure drivers are held more accountable for their driving decisions.

ICBC recently announced that as of September 1, 2019, frequent or serious driving convictions will be factored into your premiums for both Collision and Extended Third Party Liability coverages.

- Two or more convictions for minor offences (such as failure to stop at a stop sign or speeding) or one serious offence (distracted driving, impaired driving or excessive speeding) within a three-year period, will result in an increase in premiums for these coverages.

- Convictions resulting from driving violations that occurred on or after from June 10, 2019, will have the potential to impact a customer’s Optional premium starting September 1, 2019. Those premiums will increase with the frequency and seriousness of the convictions. ICBC will ultimately scan back over a three-year period for driving convictions by June 10, 2022.

- The goal is to benefit lower-risk drivers – those who don’t cause crashes or get driving convictions.

- For more information, read the ICBC news release and factsheet.

Every driver in B.C. will have a driver factor – a 3 decimal number that represents your driving experience and crash history. The driver factor will also take into consideration whether you’re a senior or a new resident. The driver factor baseline is 1.000 with a lower number being more favourable. As you gain driving experience, and for each year that you remain crash-free, your driver factor will improve.

Territory refers to where you live and your rate class refers to how you use your car. Some customers will see this portion of their premium from territory and rate class either increase or decrease – it all depends on their individual situation. Where you live is only one factor used to calculate your Basic premium. So even if there is an increase to your territory or rate class, you could still see an overall decrease based on the other factors such as driver experience and crash history.