Condo Insurance

Coverage beyond the condo corporation.

As a unit owner, you need your own insurance to cover what’s excluded under your condo corporation’s policy. The experienced advisors at Acera Insurance bring you personalized advice and coverage options customized to your exact needs.

Your guide to condo insurance.

Your condo corporation’s insurance policy only covers the original building structure and common property and assets.

It will not cover a unit owner for:

- Damage to personal belongings

- Costs of upgrades, additions or modifications

- Expenses incurred when forced to move out temporarily

- Personal liability

- Loss assessments

- Deductible assessments

This is why you need a separate condo unit owner’s policy, designed to address all of these gaps in coverage and more.

Coverage across Canada.

Get condo insurance by phone or in person at your nearest location.

Choosing your condo coverage.

Personal Property

This covers all of the personal belongings within your unit including furniture, clothing, electronics and appliances that are not built in such as fridges, stoves, washers, etc.

Improvements and Betterments

This pays for any upgrades, additions or modifications to the original unit such as floor covering upgrades, new or additional built-in closets, cabinetry or countertops, etc.

Additional Living Expenses

This covers expenses such as accommodations, transportation and food. This is for if you are forced to leave your home temporarily because of repairs being done following property damage or by order of a civil authority.

Personal Liability

This covers your legal expenses in the event you are sued and held liable for personal injury or property damage.

Loss Assessments

This pays for expenses if there is a loss in the building and the condo corporation’s insurance does not cover all costs.

Deductible Assessments

This pays your portion of the condo corporation’s policy deductible if you individually or all unit owners collectively are required to pay the condo corporation’s policy deductible.

Why choose Acera Insurance for condo coverage?

When you need more coverage for the place you live, we’ve got you covered.

Local Expertise

Backed by decades of experience serving condo unit owners in your community, you can expect local expertise and personalized advice from people you know and trust.

Custom Coverage

Partnering with Canada’s leading insurers, we provide coverage that’s customized for your exact needs and keep you informed about what’s new on the insurance market.

Dedicated Claims Support

Our in-house claims team is here to help you every step of the way and advocate on your behalf to expedite your claim as quickly and efficiently as possible.

Helpful tips from our advisors.

Our experts are here to help you understand what is and isn’t covered by your strata condo corporation’s insurance.

Answering your most common questions.

How much does a condo unit owner’s policy cost?

A condo unit owner’s policy is usually very affordable with premiums starting as low as $500. Exact pricing will depend on factors (see below) like the value of your personal belongings and the particular coverage options you choose.

What factors determine the price of a condo unit owner’s policy?

There are several different factors that determine your policy price.

- Building specifics such as:

- Building type (i.e., high-rise, townhouse)

- Building construction materials

- Age and type of roof

- Age and type of electrical, plumbing and heating

- The installation and use of devices such as security alarms, sump pumps and more

- Proximity to a fire hydrant and fire station

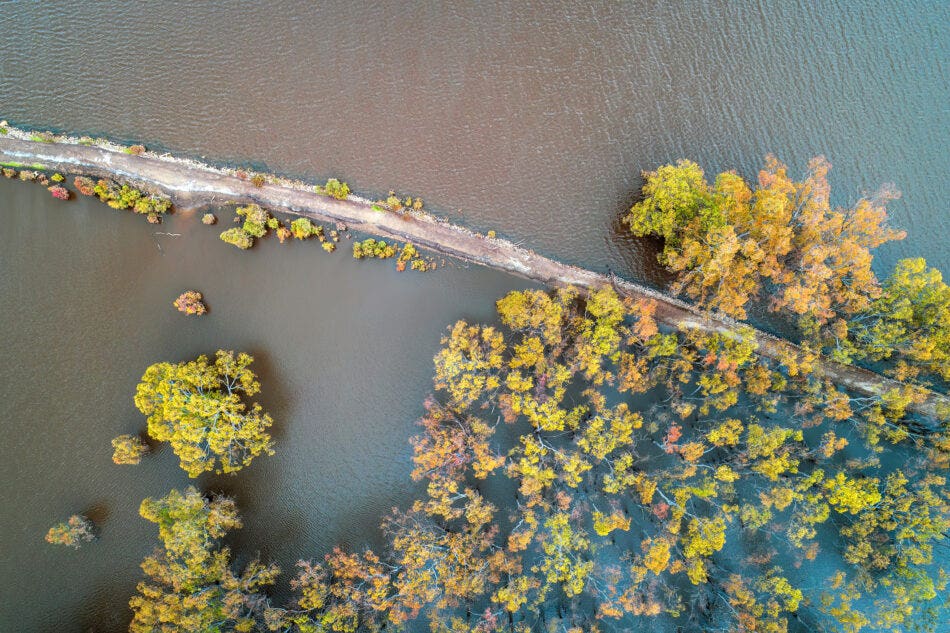

- Proximity to natural hazards such as bodies of water

- Neighbourhood statistics such as crime and claims rates

- Personal details including:

- Your age

- Your credit rating

- Your insurance and claims history

- The replacement value of your personal belongings

- The replacement value of your condo unit

Lastly, choices you make about your coverage—such as your deductible, policy limit and the addition of any endorsements—will also impact the cost of your insurance.

What does the condo corporation’s insurance cover?

The condo corporation’s insurance policy covers common property, including the building, common assets and any fixtures built or installed by the developer as part of the original construction.

If I rent out my unit, do I still need a condo unit owner’s policy?

Yes, you will still need a separate insurance policy providing coverage for any improvements and betterments, loss assessment, personal liability, and loss of income such as expenses incurred while you are unable to rent out your unit.

How can I keep my rates down?

There are a few ways to keep your rates down:

- Create an inventory to ensure you have sufficient coverage for your personal belongings and you won’t pay for coverage you don’t need.

- Install mitigation devices to be eligible for insurer discounts if you have smoke, carbon monoxide, water and monitored security alarms as well as devices such as sump pumps and backwater valves.

- Review your insurance at least once a year or when you experience a major life change.

- Allow your insurance company to run a soft credit check. This will not impact your credit rating.

- Stay insured and stay on top of insurance payments. Insurance companies reward those who’ve been consistently insured with lower rates. You can usually pay your premiums in instalments if annual payments are too difficult to make.

- Only submit a claim if you can’t cover the damage yourself. Small claims can lead to big increases in your rates.

What types of damage is covered?

Your condo unit owner’s policy will cover damage to your belongings and your unit caused by accidents and hazards out of your control. Common sources of claims include:

- Theft

- Vandalism

- Fire

- Smoke

- Explosions

- Wind

- Water damage (the leading cause of claims)

There are also additional coverages (called endorsements) that you may want to consider adding. For example, earthquake, sewer backup and overland flooding are typically not included in a standard condo unit owner’s policy.

Why do I need deductible assessment coverage?

In the event of a claim on the condo corporation’s insurance policy, unit owners may be held responsible for paying a portion or all of the deductible. For example, if the condominium corporation has 10 owners and the master policy has a $250,000 deductible, the condo corporation could require each unit owner to contribute $25,000. If the damage is found to have originated from one unit, that unit owner could be held responsible for the entire deductible.

Additionally, some condo corporation policies provide earthquake coverage with a deductible as a percentage of the entire policy limit. Deductible assessment coverage protects you from paying out of pocket if you are required to pay any part of your condo corporation’s policy deductible, which can easily be in the tens of thousands of dollars.

Personal insurance insights for your everyday.

-

Insurance blind spots facing luxury condo and high-net-worth owners

Condo insurance risks high‑net‑worth owners can’t ignore

-

Protect your home from water damage

Water damage is one of the most common property insurance claims. But insurers do not treat all water damage as…

-

Understanding additional living expenses insurance

Having to leave your home can be tough even when you’re off on a fun vacation. Having to leave your…