Strata Deductible Insurance

Protect yourself against rising strata deductibles.

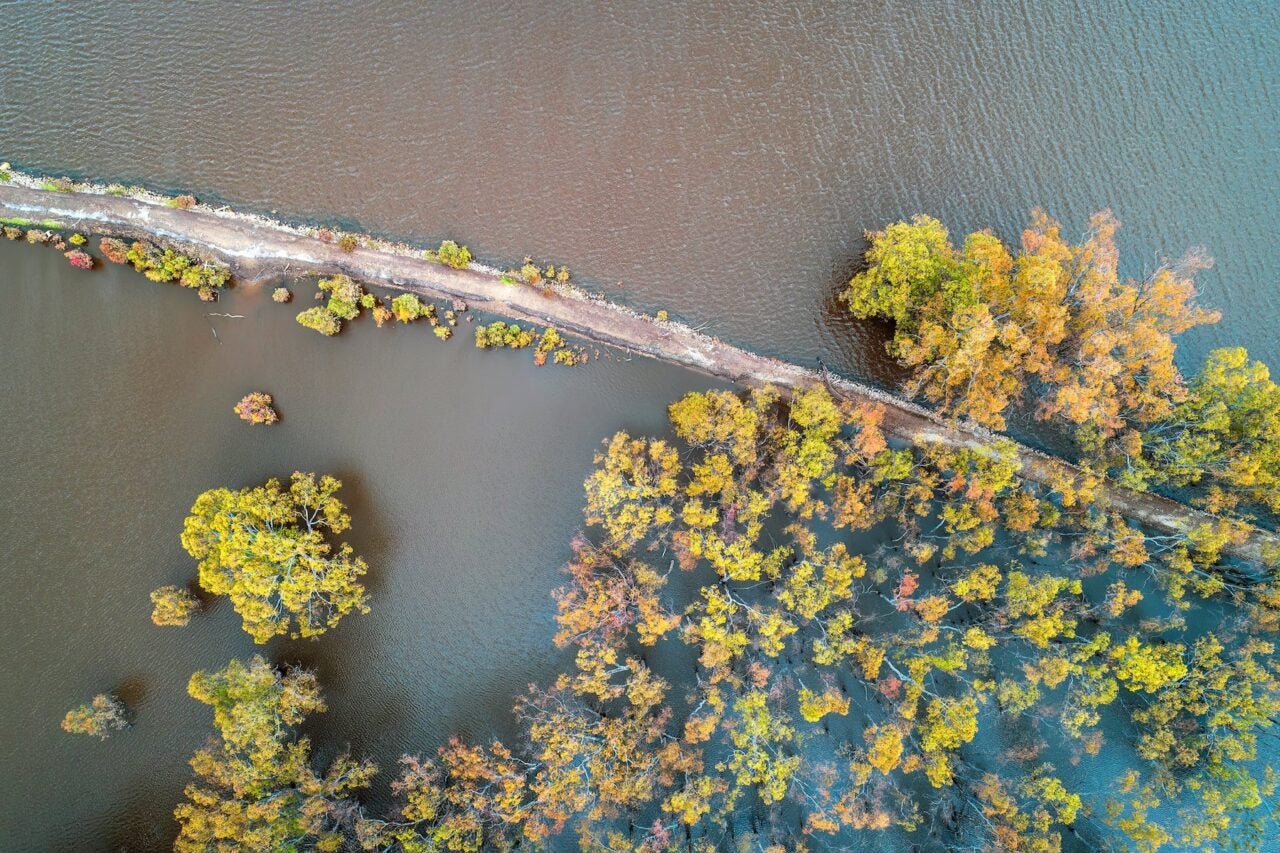

Water damage and sewer backup deductibles on strata corporations’ insurance policies have risen dramatically in recent years. Strata unit owners can be held liable for these high deductibles, so it’s important to take preventative measures.

Your guide to strata deductible insurance.

Strata unit owners might be responsible for the deductible on their strata corporation’s insurance policy if they’re found at fault for water or sewer backup damage. That’s where excess loss assessment coverage, or strata deductible coverage, comes in.

- If you’re found responsible for damages caused to your building, there can sometimes be a gap between your personal coverage and the Strata’s deductible

- We can help you increase your personal deductible assessment coverage limits to cover that gap and give you peace of mind

- We can offer limits up to $1 million, giving you more coverage than the usual deductible cap of $25,000-$100,000

Coverage across Canada.

Get strata deductible insurance by phone or in person at your nearest branch.

Why choose Acera Insurance for strata deductible coverage?

Available 24/7

Our in-house claims adjusters are available day and night to act on your behalf if you ever need us in an emergency.

Longtime Expertise

As the first insurance broker in Canada to offer stand-alone strata deductible coverage, we’ve developed an expertise and specialization to be able to answer all your questions.

Lots of Options

We work with many insurance carriers and can find the right strata deductible coverage that best suits your unique needs, no matter your situation.

Helpful tips from our advisors.

Our advisors can help you fully understand everything you need to consider when it comes to strata deductible insurance.

Answering your most common questions.

Can I buy strata deductible coverage if I rent my unit out?

Yes, coverage is available for units rented to a single family with a signed annual lease.

Can I, as a unit owner, be assessed my strata’s deductible if I’m renting my unit out to a tenant?

Yes, it’s a common misconception that tenant’s insurance would automatically cover a strata deductible assessment.

Can I make changes to my strata deductible policy mid-term?

Yes, if your strata’s deductible changes during your policy term, you can increase or reduce your limit, or cancel your policy altogether. Keep in mind, most policies have a minimum retained premium which is the minimum amount that wouldn’t be refunded on a cancellation.

How do I find out what my strata’s deductible is?

Your strata is responsible for communicating any changes to its insurance policy that affects unit owners. Your Schedule of Unit Entitlement document will confirm what your unit could be assessed in the event of a claim. If you have questions about your strata’s deductible, or how deductibles work, contact an Acera Insurance advisor.

Personal insurance insights for your everyday.

-

Insurance blind spots facing luxury condo and high-net-worth owners

Condo insurance risks high‑net‑worth owners can’t ignore

-

Protect your home from water damage

Water damage is one of the most common property insurance claims. But insurers do not treat all water damage as…

-

Understanding additional living expenses insurance

Having to leave your home can be tough even when you’re off on a fun vacation. Having to leave your…