Businesses of all sizes will continue to face challenges arising from the persistent cycle of economic uncertainties that include inflation, geopolitical headwinds, environmental disasters and capital constraints.

These trends in combination with changes to assessing potential risks, are forcing commercial insurers to address four critical challenges — which affect coverages and rates for businesses.

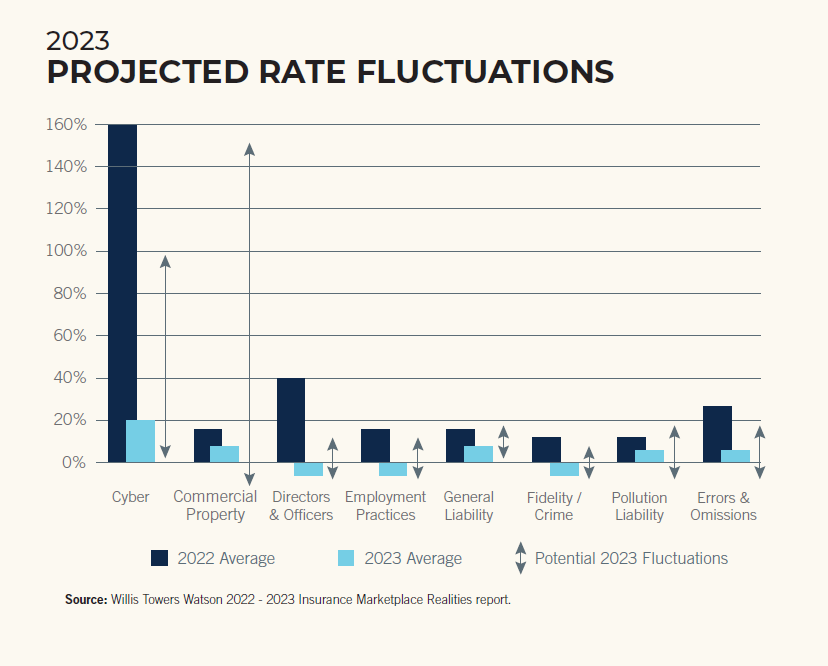

- The insurance market is currently in flux. Rate softening, rate stabilization and rate hardening are all happening simultaneously in different lines and sublines of coverage. Insurers are readjusting on the fly to competitive pressures as they look to maintain and grow market share without losing profitability. Inflationary costs from losses already suffered and uncertainty in forecasting for future claims severity and frequency are adding complexity to underwriting risks.

- Risks are undergoing rapid evolution, particularly in the areas of natural catastrophes, net-zero emissions transitions, supply chain, emerging risks, disruption of traditional industries and cyber risks.

- The increasing and unstable rates observed during January 2023 renewals have added to the uncertainty surrounding tightening capacity in both traditional and alternative (re)insurance markets.

- In order to navigate the evolving landscape of risks, commercial insurers must recognize the significance of talent acquisition. They need to proactively enhance their capabilities and attract skilled individuals in a labour market that is becoming increasingly competitive. This is particularly crucial as underwriting and claims processes transition from being based on intuition and experience.

Trends Impacting the Marketplace Throughout 2023

- Inflation and volatility is impacting property values and leaving many businesses underinsured.

- Environmental disasters are happening more frequently and, as a result, (re)insuring properties in impacted areas has become challenging.

- Cyber incidents continue to be the number one risk facing businesses around the world.

- Global supply chain disruptions continue to be an issue and are impacted by geopolitical risks, such as the war in Ukraine.

- Environmental, social and governance policies and principles are having a more direct impact on assessing a company’s liability risk and potential exposures.

Managing Your Risks

As the market continues to recover from the impact of COVID-19, new economic uncertainties are arising that will have a direct impact on insurance rates. We have identified five trends that could impact your insurance throughout 2023.

Inflation & Economic Uncertainty

We’ve all felt the impact of inflation throughout the past year, whether at the grocery store, higher utilities or the rising costs of property (seen most acutely in the commercial property market).

The cost to rebuild and replace property or inventory following a loss is continuing to spiral. We are seeing rising prices and supply chain issues, as well as extended repair times due to a lack of labour availability. When you couple the rising cost of materials with labour market disruptions and supply shock, the costs of claims borne by insurers are substantial.

This means that when a catastrophe strikes, the price to rebuild and restore can skyrocket, leaving even conscientious individuals and organizations at risk of being underinsured.

What you can do:

- Consider using a professional appraiser or engineer to determine your property value. Professional appraisals provide a higher degree of certainty in relation to existing building conditions and the cost to rebuild. Engineers can also help identify potential hazards, provide estimates around foreseeable loss costs and make risk control recommendations.

- Accurately value your inventory to reflect the rising costs of goods.

- Consider your business interruption exposure in the event of an incident. With supply chain shortages resulting in longer lead times, coupled with labour and material shortages, the time needed to rebuild following a loss will now take longer — meaning a company’s ability to earn revenue could be disrupted for a longer period.

- Create backup plans for equipment and machinery failures as new parts may not be readily available.

- Use inflationary cost trends for incremental increases to help determine the value of your assets.

Natural Disasters & Catastrophic Losses

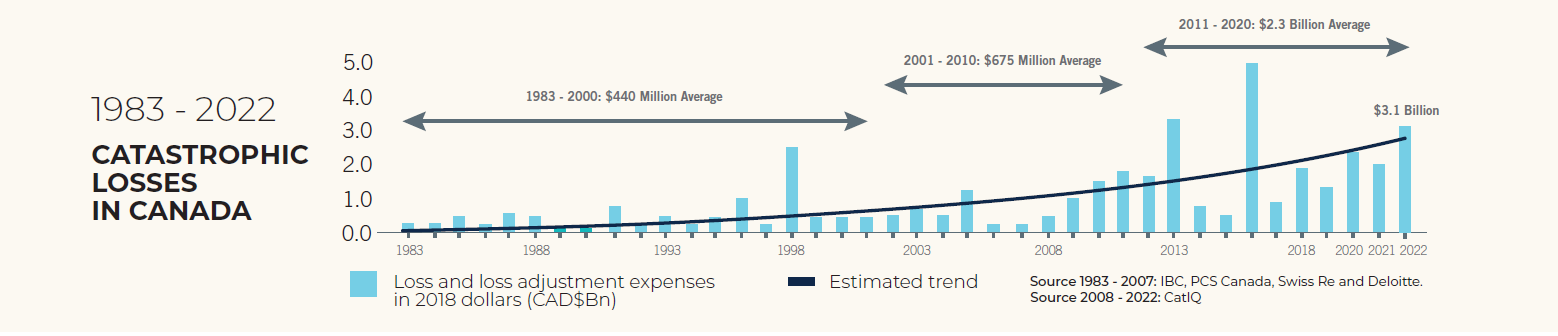

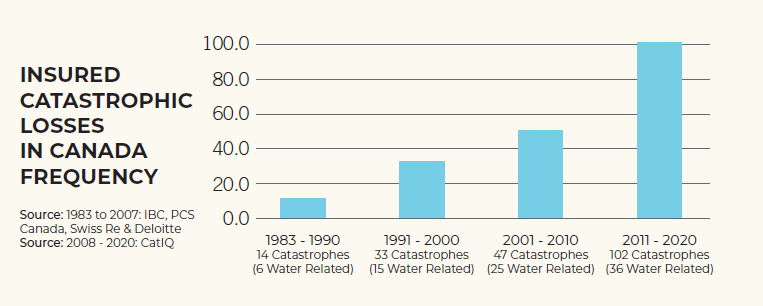

The impacts of climate change continue to be felt globally as devastating “once-in-ten-year” weather events continue to increase in frequency and severity. To manage catastrophic claims, insurers are increasingly resorting to reinsurance, which is when they transfer a portion of their risks to other parties. They also continue to increase rates to compensate for these events in certain market segments, such as property.

Severe weather remains a serious concern within the commercial and personal insurance industry. Nationwide catastrophic weather last year — such as Hurricane Fiona and the Ontario-Quebec derecho — resulted in $3.1 billion in insured claims, making 2022 the third worst year for losses in Canadian history.

What you can do:

- When looking at insurance for your commercial property, identify and understand what your potential climate risks are. Are you in an area that has a history of flooding, extreme storms or wildfires? Work with an expert commercial insurance broker to determine how these risks impact your rates.

- Have an emergency plan in place to help ensure business continuity and reduce long-term costs.

- Use construction materials that are built to withstand punishing weather patterns. Underwriters consider these materials when determining your rates.

Cyber Liability

Cyber incidents are currently ranked as the number one risk facing businesses globally, according to Allianz’s 2023 Risk Barometer. In 2022, the average cost from data breaches reached an all-time high of $4.35 million, and it is expected to surpass $5 million in Canada.

“It can be easy for companies who’ve never experienced a cyberattack to underestimate their level of preparedness… but the fact of the matter is that cyber risk isn’t going away, and companies are more dependent on technology than they’ve ever been in the past.”

– Patricia Kocsondy, Head of Cyber & Tech at Beazley

With the increasing adoption of remote work, digital transformation and the growing sophistication of cyberattacks, Canadian businesses need to be prepared for a cyberattack, now more than ever — including having adequate cyber insurance.

What you can do:

- Invest in cyber security. This includes ensuring all software is up to date, setting up multi-factor authentication, instituting minimum password lengths and implementing cyber security training.

- Back up all data on a regular basis to a second source, such as a hard drive or cloud storage, to ensure that it is protected in the event of a breach.

- Create an incident response plan that is tailored specifically to your business based on threats that you and your employees are most likely to encounter.

- Continuously train your employees on cyber security and how to spot a potential threat.

Global Supply Chain Disruptions

Between geopolitical issues, major weather events and the continued impacts of the COVID-19 pandemic, many businesses continue to feel the effect of supply chain disruptions.

The pandemic, supply chain issues, material shortages and a higher-than-targeted inflation rate are having a compounding affect on the Canadian economy.

Source: Liberty Mutual Insurance

The uncertainty has forced many businesses to take a long-term view of potential disruptions and to work with suppliers to develop alternatives to address these risks. This is key for working with insurers to help develop risk management plans.

What you can do:

- Take financial precautions to ensure you and your suppliers have sufficient resources and coverage should a disruption occur.

- Diversify your business’ supply chain and ensure that the cost of disruptions is factored into your business’ inventory planning.

- Plan for different scenarios so that if something bad happens, you are ready to respond quickly and nimbly with minimal impact to your business operations.

Environment, Social and Governance Policies

Insurers are increasingly scrutinizing companies’ environmental, social and governance (ESG) policies and performance, often to improve the transparency of risks not captured by conventional financial metrics.

Issues such as pollution, diversity and inclusion, and corporate conduct continue to receive public attention, resulting in more litigation and insurers using ESG to assess a company’s liability risks and exposures. While the focus has largely been on environmental policies, insurers are increasingly concentrating on social and governance policies. This is becoming especially prominent when working with small and medium-sized businesses.

What you can do:

- Understand what ESG policies are and how they can impact your business. Some questions to ask yourself include: What is your company’s carbon footprint? Do you have a diverse company culture that provides equal pay and advancement opportunities? Are you transparent in your communication with shareholders?

- Develop a clear roadmap for addressing risks and changes related to implementing ESG policies. Your organization needs to be aligned on these changes for them to be effective.

- Work with your broker to discuss how you would like to address these risks to better develop ESG policies and practices.

Contact us to discuss ways your business can mitigate risk.

Related reading: