We’ve identified four risks that could impact your commercial insurance in 2024; these are similar to last year as the world continues to navigate escalating natural disasters, global unrest and high inflation.

In response, insurers will maintain a careful balance of managing risk with their own operational objectives in mind, which will affect coverages and rates for business.

Catastrophic Weather

As demonstrated by this past year’s wildfire season — which caused damage from coast (British Columbia) to coast (Nova Scotia) to coast (Northwest Territories), and elsewhere in between — catastrophic weather will continue to be a significant hurdle for businesses.

Securing insurance for organizations located in areas prone to natural disasters remains a growing challenge; insurers continue reevaluating their risk assessments and underwriting methods in response to the escalating occurrences of floods, wildfires, storms, hurricanes and more, which cause billions in insured losses each year in Canada.

What This Means for Your Business

- Even if your business isn’t damaged by a flood, storm or wildfire, it can be indirectly affected by evacuation orders, road closures and more. Developing an emergency plan can help support business continuity and reduce long-term costs in the event your normal operations are interrupted.

- Insurers are becoming more stringent on what, when and how they’ll offer coverage during extreme weather seasons. Speak with your Acera Insurance risk advisor to understand how this is affecting your industry and to discuss loss prevention measures your business can introduce to mitigate risks.

Extreme Weather Impacting Reinsurance

Reinsurers are reconsidering the risks they’ll assume and increasing prices in response to more frequent and damaging

extreme weather. It’s estimated that reinsurance rates will increase by double digits in 2024, but not to levels seen in 2023,

which ranged between 25% and 60% in Canada. This may lead some insurers to be stricter with their underwriting methods and

possibly increase premiums.

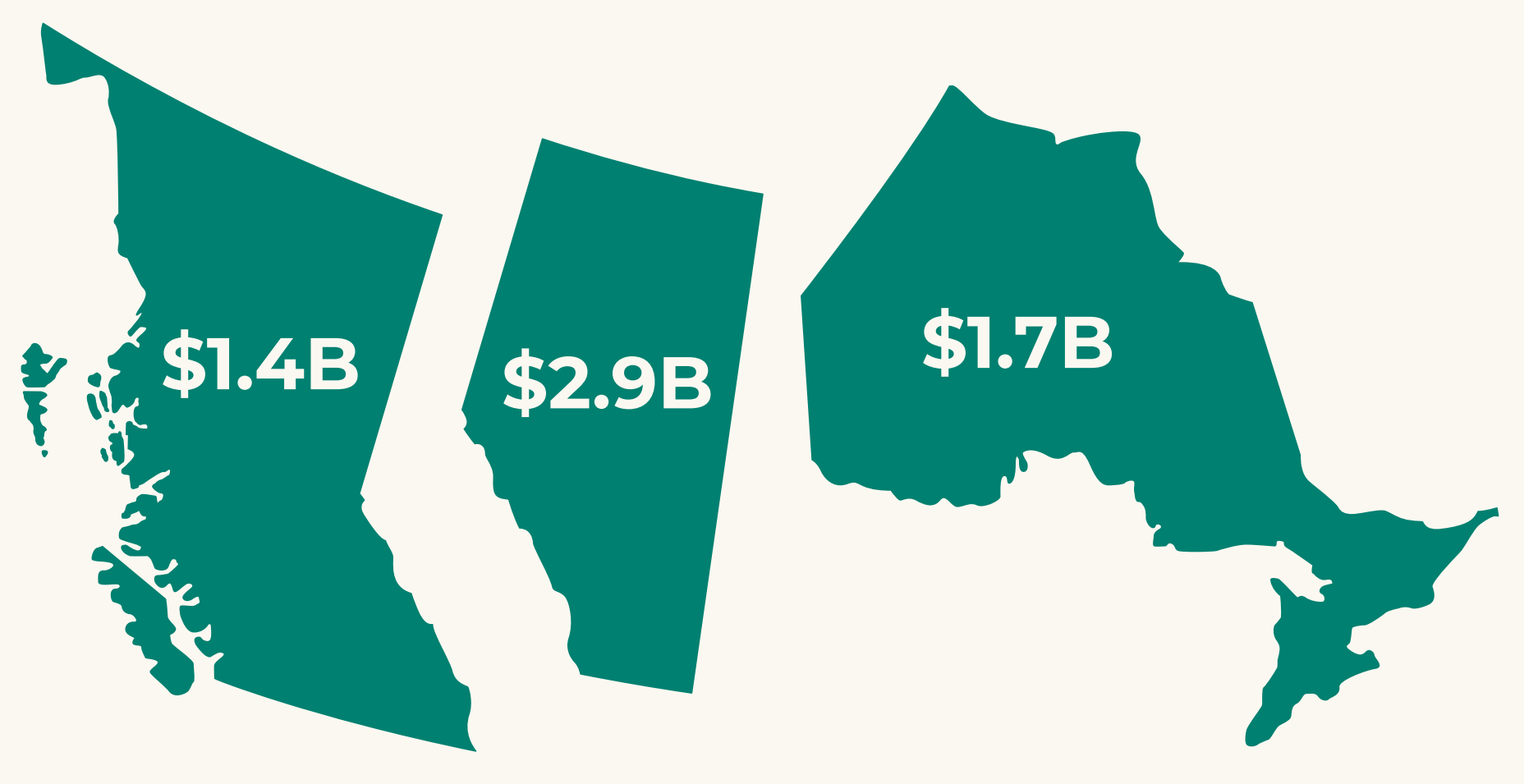

Notable Natural Catastrophic Insured Losses, 2020-2023

National Total = $10 B

Catastrophic weather in Alberta,

British Columbia and Ontario has

accounted for over 60% of the

insured losses across Canada in the

past four years.

Note: 2023 total are approximate based on data

available in November 2023. Source: Insurance

Bureau of Canada

“Insurers will continue to monitor the longevity of remaining in high-risk areas, with the costs of adjusting claims and reconstruction increasing. In time (beyond 2024) certain areas of the country may become too expensive to insure against natural catastrophic disasters.”

Richard Dhillon, Commercial Marketing Director

Inflation & Shortages

Supply chain disruptions, skilled labour shortages and inflation will continue to drive material costs and lengthen completion timelines for repairs or reconstruction.

The risk this presents for commercial properties is twofold:

- Dealing with Lengthy Business Interruptions. Delays and shortages in materials and skilled labour could prolong the period of time that a business is unable to earn revenue should their property be damaged or destroyed.

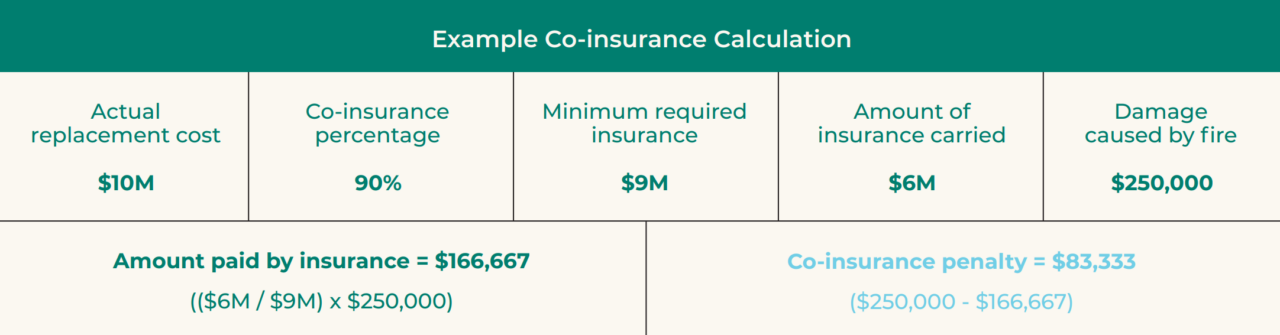

- Being Underinsured & Co-Insurance Penalties. A business will be on the hook for any outstanding balance if the cost to repair or reconstruct damaged property exceeds the value listed on its policy. Furthermore, being underinsured can result in a punitive co-insurance penalty, which reduces the payout a business will receive for an insured loss.

The average cost to rebuild property is 12% – 15% higher than it was prior to the pandemic.

What This Means for Your Business

- We recommend using a professional appraiser or engineer to ensure you’re insuring your commercial property to its true value. Insuring to value means the limit in your policy should sufficiently cover the cost to repair or replace the damaged property back to the same level of design and quality, in accordance with current building bylaws, codes and regulations.

- Speak with your Acera Insurance risk advisor about where your insured value falls within the co-insurance clause. Most insurers require commercial property be insured at 80%, 90% or 100% of the true replacement value. If you choose to insure at a lesser value, you will be considered a ‘co-insurer’ and are agreeing to share in covering the cost of any losses with the insurer (as illustrated in the example co-insurance calculation below).

- Be prepared for a prolonged business interruption in the event of a loss. Create backup plans for equipment and machinery failures as new parts may not be readily available, and speak with your Acera Insurance risk advisor about business interruption coverage.

“We’re seeing more insurers no longer offering stated amount without professional appraisals on buildings; whereas in years past, this coverage was often afforded with just a signed statement of values.”

Pam Lee, Director, Broking,

British Columbia and Yukon

Cybercrime

Cybercrime continues to be one of the greatest threats facing Canadian organizations.

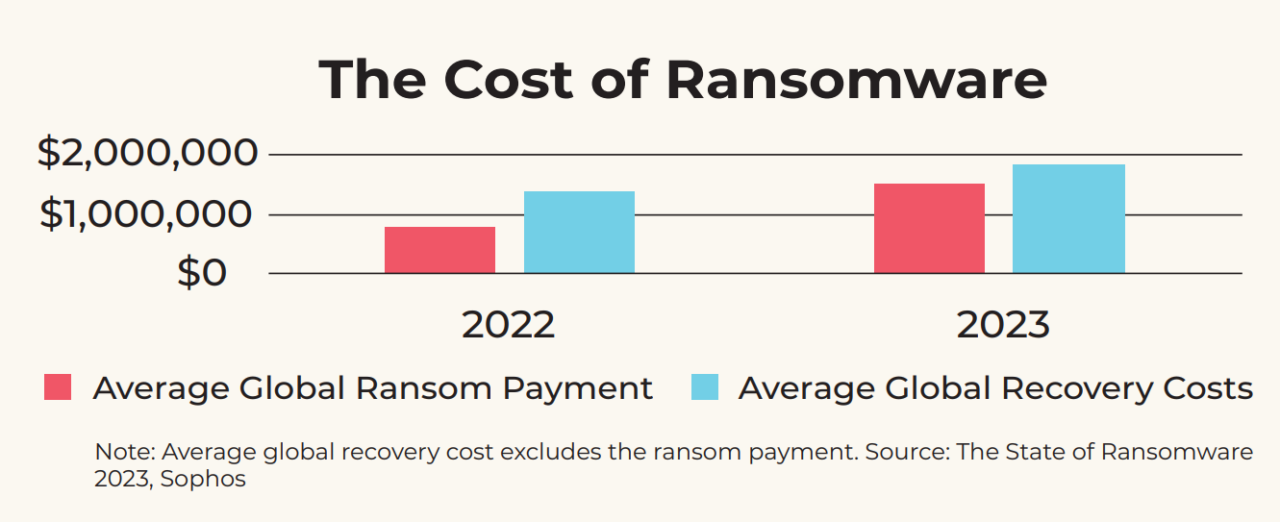

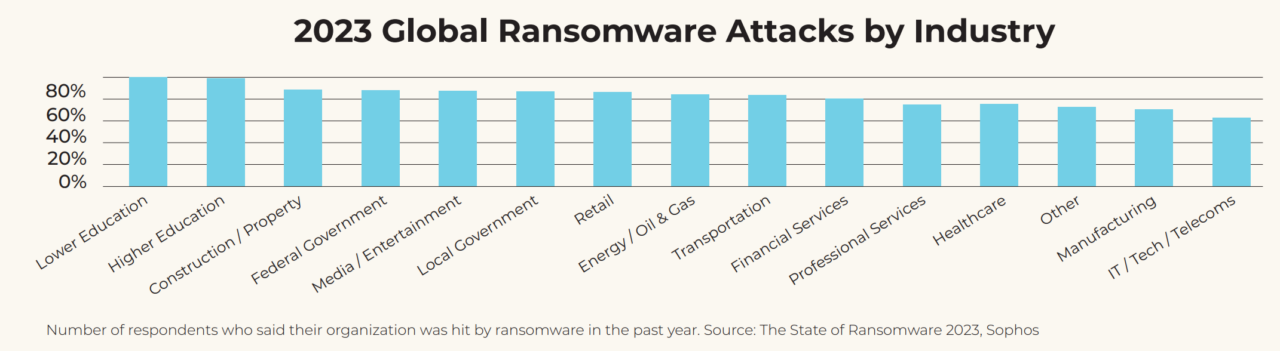

Ransomware in particular is the most persistent and disruptive cyberthreat, accounting for 55% of all cybersecurity incidents in Canada in 2021. More than just financial extortion, ransomware significantly affects a business’ bottom line due to operational downtime resulting from system encryption plus the expenses to recover from the attack.

That said, cybercriminals are increasingly launching sophisticated and severe attacks through a variety of means, including the utilization of emerging technology — such as artificial intelligence (AI) and machine learning (ML).

What Does This Mean for Your Business

- Robust and regular data backups remains the best defence against a ransomware attack; however, with businesses ramping up their efforts, cybercriminals are pivoting towards stealing highly sensitive data without system encryption and threating to publicly leak or sell this information on the dark web unless an organization pays up. This continues to underscore the importance of protecting your business with cyber liability coverage.

- Cybercriminals are increasingly wreaking havoc by targeting cyber service providers to spread malware to users all along the network supply chain. A recent example of this was the attack on Log4J, a widely used logging library software, which saw more than 100 hacking attempts occur every minute at the height of the exploitation. If your business uses third-party cyber services — such as payment processing, software, IT, and marketing services and products — you must ensure your vendor(s) subscribe to a high level of cybersecurity.

“Businesses can no longer be complacent in ensuring their own systems are adequately protected. They also have a responsibility to review and ensure their third-party providers subscribe to a high level of cybersecurity.”

Hillaine McCaffrey, Senior Underwriter & Broker, D&O and Cyber

Escalating Liability Awards

One trend we’re monitoring is escalating liability awards.

US juries have been penalizing large corporations with extreme settlements, known as ‘nuclear’ verdicts. The costliest verdicts in the US have more than tripled between 2015 and 2019, from $64 million to $214 million. The states where nuclear verdicts are most common are California, Florida, New York and Texas; and the industry hit hardest is the transportation sector, with settlements rising by more than 550% between 2012 and 2019.

For Canadian businesses with operations in the US, it’s paramount that you speak with your risk advisor to ensure you are adequately covered and properly placed in the different states.

While nuclear verdicts are not commonplace in Canada (yet), litigation against organizations is steadily climbing. For example, seven out of 10 small businesses in Canada faced at least one legal dispute in the past three years, a 230% increase since 2015.

As your risk advisor, Acera Insurance is committed to providing our expert advice and recommendations to protect your business from liability exposures.

Contact your Acera Insurance risk advisor to discuss these and other hazards.

While insurers will maintain a strict approach to risk assessment in 2024, they are demonstrating a willingness to be more accommodating when thorough and comprehensive underwriting information is available. We will work with your business to gather the detailed information that underwriters are prioritizing in response to today’s escalating risks.

Disclaimer: This document is advisory in nature. It is offered as a resource to be used together with your professional insurance and legal advisors in developing a loss control program. This guide is necessarily general in content and intended to serve as an overview of the risks and legal exposures discussed herein. It should not be relied upon as legal advice or a definitive statement of law in any jurisdiction. For such advice, an applicant, insured or other reader should consult their own legal counsel. No liability is assumed by reason of the information this document contains.