The following key risks, market trends and proactive steps will impact your business’ insurance and risk management strategies — and resiliency — in 2025.

Dive into our insights to empower your business to face the year with confidence.

3 Key Threats to Canadian Businesses in 2025

The growing severity of natural catastrophes

Last year was Canada’s costliest natural catastrophe year on record. The wildfire in Jasper, flooding in Ontario and Quebec, the hailstorm in Calgary and flooding across British Columbia resulted 250,000 insurance claims and $8.5 billion in insured losses across the country. The increasing frequency of natural disasters is making Canada a risker place to work — and insure.

Insurers and reinsurers continue searching for solutions to stay strong amid the increasing frequency and severity of natural disasters, for which losses are further ballooned by inflation. As a result, businesses located in high-risk areas may face higher premiums, limited coverage and elevated deductibles, as well as increased scrutiny in the event of a claim.

“For properties in areas prone to catastrophic weather, obtaining coverage may become more difficult or result in higher deductibles or capped limits. Insurance policies are increasingly likely to carry specific exclusions or limitations where climate events are more frequent.”

Janelle Lordon

Director, Complex Risks

How frequent natural catastrophes are disrupting Canadian businesses

If your business is located in an area prone to wildfires, flooding, wind and tornadoes, hailstorms, hurricanes or earthquakes, you should anticipate strict underwriting measures, which may include exclusions or limitations to your policy.

How to protect your business from natural catastrophes

- Factor in that replacement cost appraisals do not capture escalated expenses that can follow a natural catastrophe. For example, increased demand for labour and material shortages drive up replacement costs following a severe weather event.

- Develop and maintain a detailed emergency response plan, which outlines response protocols, communication channels, evacuation procedures, roles and responsibilities, and other important procedures, processes and considerations.

- Mitigate the damage that extreme weather may cause by implementing floodproofing measures, using hail- and fire-resistant materials, and creating a wildfire defence zone around your property.

- Participate in regular risk assessments and loss prevention programs that your insurer may offer. Doing so may lead to premium discounts or broader coverage as it demonstrates proactive risk management.

- Consider alternative coverage options, such as parametric insurance, which speeds up the claims process by paying out a pre-set amount instead of compensating for the actual loss incurred.

The importance of earthquake insurance

The ability to acquire earthquake insurance with a reasonable premium and deductible continues to be a challenge in specific regions across Canada, particularly the west coast in British Columbia. If your business is located in a seismically-active region and earthquake insurance is available to you, it’s paramount to add this coverage to your portfolio — not only to protect your business but also to satisfy lender and financing agreements. Speak with an advisor as Acera Insurance has access to markets that offer standalone earthquake insurance and deductible buy downs.

The growing threat of cyberattacks on Canadian businesses

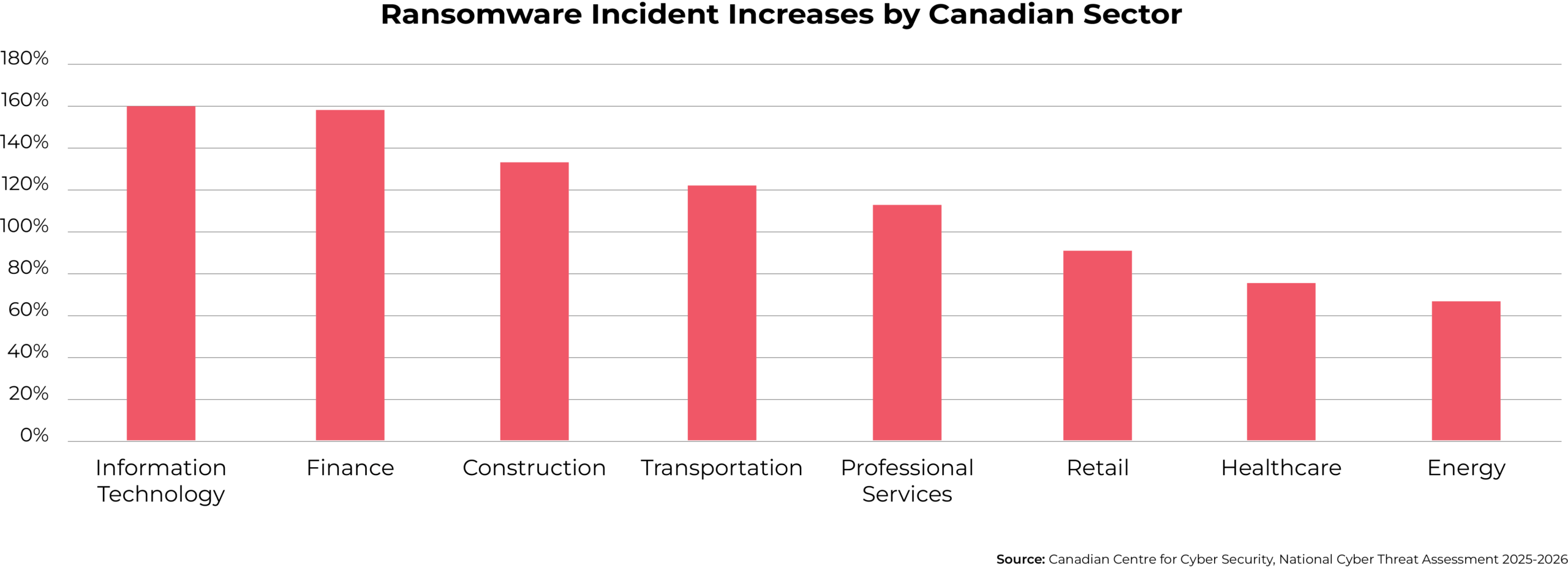

Cybercrime continues to be a significant threat to Canadian companies. From ransomware to social engineering, phishing, AI-driven impersonation and more, cybercriminals launch sophisticated attacks at all businesses, regardless of sector or size.

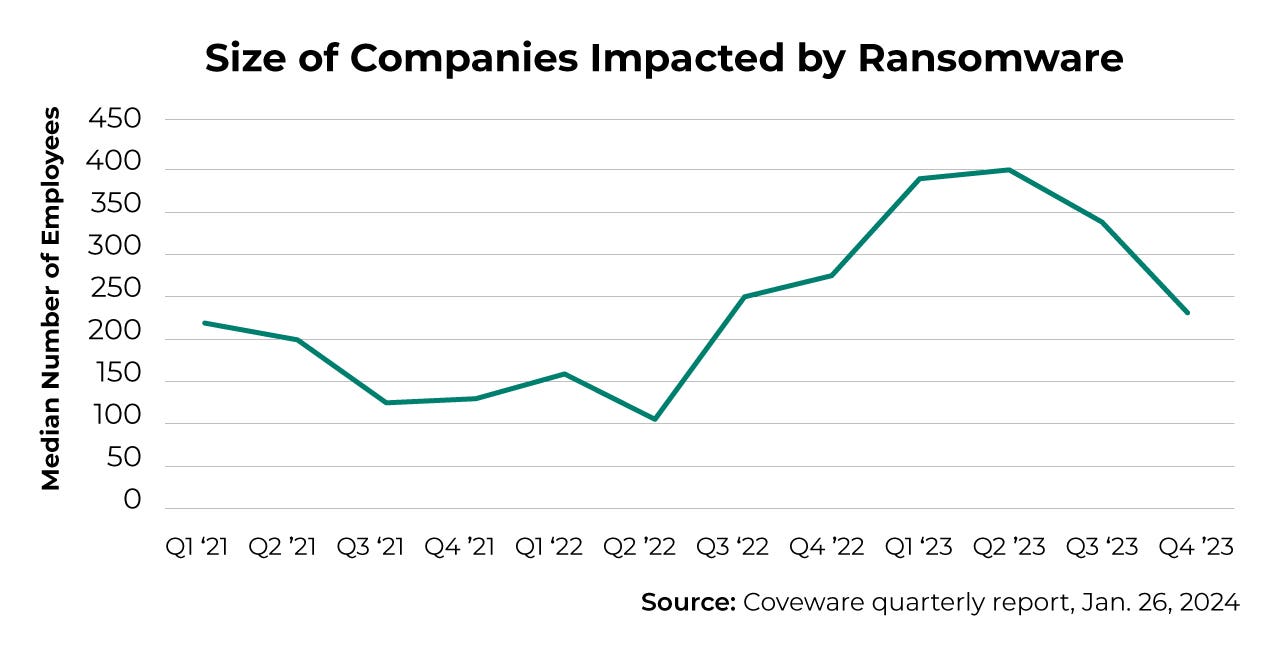

For example, while headlines tend to focus on successful cyber breaches of large corporations, the reality is that cybercriminals predominantly target their ransomware attacks at small and mid-market companies.

Why cybercrime remains a major risk for Canadian businesses

The Canadian Centre for Cyber Security reported that the average ransomware payment in Canada reached $1.13 million in 2023, which was an increase of nearly 150% over a two-year period. But, if your business falls victim to a cyberattack, you’ll face hefty costs beyond ransom payments or fraudulent fund transfer amounts. Cyber breaches also lead to additional contributors to financial hardships including:

- Business interruption

- Digital assets restoration

- Forensic investigations

- Lawsuits

- Regulatory fines and penalties

- Notification costs and identity fraud monitoring

- Reputational repair and crisis management

How to protect your business from cyberattacks

- Invest in cybersecurity and practice good cyber hygiene. This includes, but is not limited to, implementing regular penetration testing, ongoing staff training and making system upgrades to mitigate vulnerabilities.

- Protect your business with cyber insurance, which can help cover losses stemming from data breaches and cyberattacks, such as those listed above.

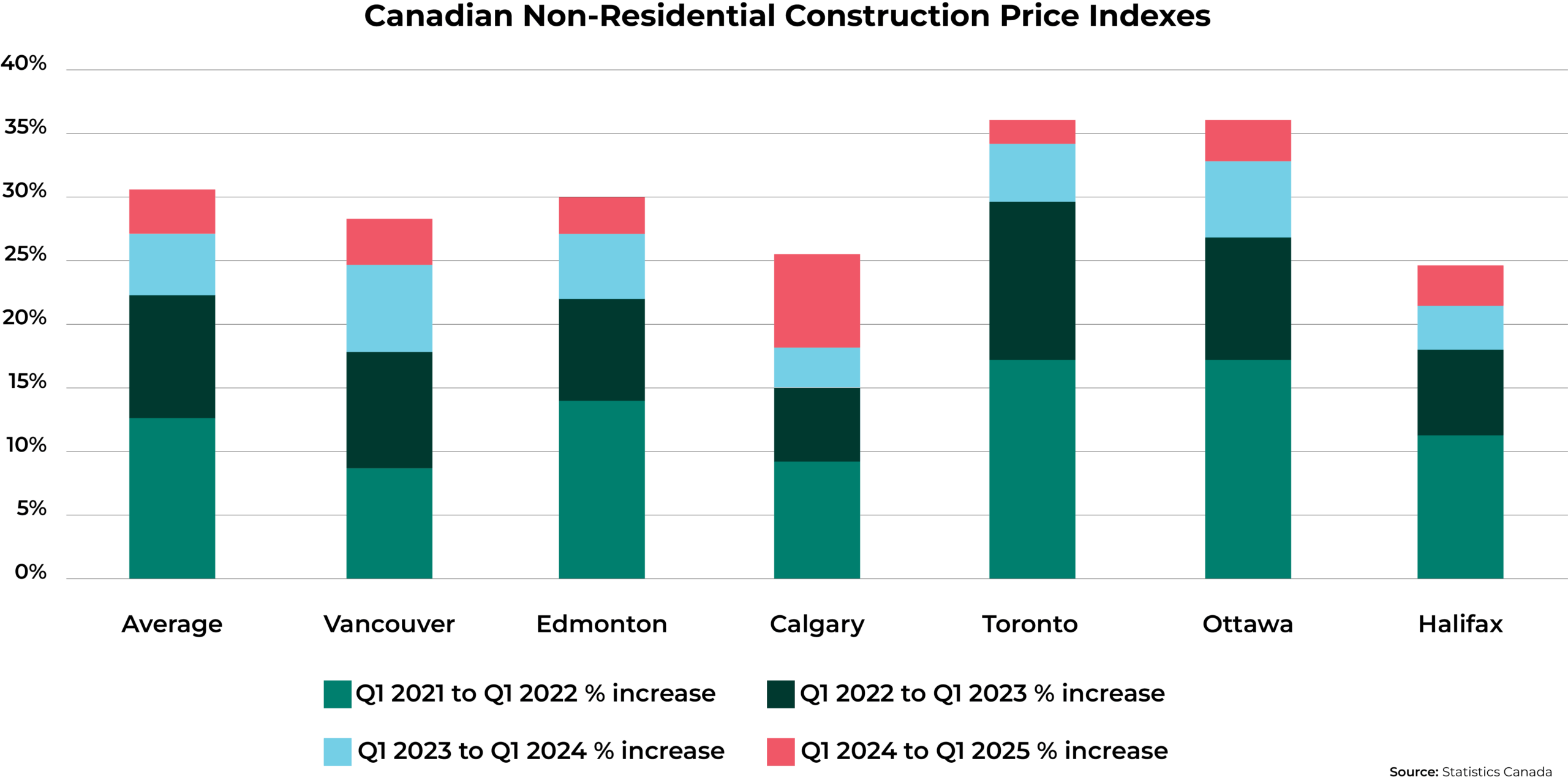

The increasing cost of property repairs and supply chain disruptions

The cost of repairing or replacing damaged property has increased sharply, driven by rising prices for construction materials, labour and replacement parts, as well as persistent supply chain issues.

Why rising costs and supply chain delays threaten business budgets

Increasing costs make each claim more expensive to solve. This may put your business at risk of being underinsured or at fault for a co-insurance penalty, both of which could result in significant out-of-pocket expenses in the event of an insured loss.

How to protect your business from rising costs

- Enhance your risk management practices to strengthen claims reduction strategies and focus on loss prevention.

- Regularly conduct insurance appraisals to ensure your property coverage aligns with current replacement costs and bylaws.

- Maintain open and proactive communication with insurers to help manage your coverage terms and potential premium increases.

- Diversify your supply chain to avoid over-reliance on a single region or country.

“Ongoing supply chain issues are causing delays in repairs and replacements, prolonging claim resolutions and adding to overall claim costs due to extended business interruptions.”

Leah Wood

Director, Claims & Loss Control

The shift to sustainability in property damage claims

Insurers are increasingly focusing on integrating eco-friendly practices. As such, in the event of a claim, your business may be encouraged to use sustainable materials and energy-efficient systems when repairing or replacing damaged property. This movement stems from improved environmental awareness, regulatory pressures, and insurers looking to reduce long-term risks and costs.

3 trends shaping the Canadian insurance landscape in 2025

The rise of data-driven decisions in the insurance industry

Insurers are increasingly utilizing technology and data to make decisions where pricing, claims and predictive modelling are concerned.

Pros

This can enhance performance and improve customer experience by improving:

- Precision in risk assessments

- Process efficiency

- Strategic decision making

Cons

Increased automation may also result in:

- Diminished personal interactions

- Underinformed decision-making and generic solutions

Advice for your business

While data-driven decisions can lead to more efficiently and competitively-priced products, you should continue to maintain a close relationship with your Acera Insurance advisor to ensure your insurance and risk management solutions are tailored to your specific needs.

How reduced insurer profits are shaping the insurance market

Natural catastrophes across Canada are significantly impacting many insurers’ profitability as they respond to escalating claims — both in terms of volume and cost.

These significant losses are impacting the combined operating ratio (COR) of many primary insurers and by the end of 2024, its likely that many CORs are expected to reach or surpass 100%, indicating that insurers will see a reduction in their profitability.

How insurer profitability impacts businesses

If your business is located in a high-risk weather region, you will likely face higher premiums and stricter underwriting measures, potentially including limited coverage availability.

“Acera Insurance has many options with our in-house underwriting programs

Stuart Menzies

that can provide capacity to support your risk requirements. Our programs have remained stable with long-term financial success and are well- positioned to continue to bolster your business’ success.”

Director, Commercial Underwriting

Advice for your business

Insurers are also placing greater focus on long-term, sustainable risk mitigation practices, underscoring the importance of prioritizing risk management strategies for your organization.

Lower interest rates are increasing competition in the insurance market

Decreasing interest rates are impacting insurers’ profitability. In response, reinsurers are taking on more risk, which is increasing competition in the market and leading to more aggressive pricing.

What lower interest rates mean for insurance pricing and market stability

In the short term, this might appear beneficial as your business could save on premiums. The risk, however, is that market saturation may result in less disciplined underwriting, which could undermine stability across the industry in the long term. There’s also the potential that, by prioritizing volume over risk assessment, insurers may introduce exclusions on your policy that could leave your business vulnerable.

Advice for your business

- Maintain open communication with your Acera Insurance advisor. They will ensure you are not sacrificing coverage for a lower premium.

- Focus on long-term consistency by working with your Acera Insurance advisor to evaluate your coverage stability and quality.

Is it time for your business to revisit its insurance deductible?

Your business may benefit from long-term cost savings by choosing a higher deductible. Bear in mind this also means you have a higher financial responsibility if a claim does occur. But this approach can be financially beneficial if your business prioritizes risk management strategies that effectively reduce the likelihood of losses. Additionally, demonstrating a strong record of risk management can also lead to more favourable terms and competitive options from insurers.

Trade War: US-Canada tariffs

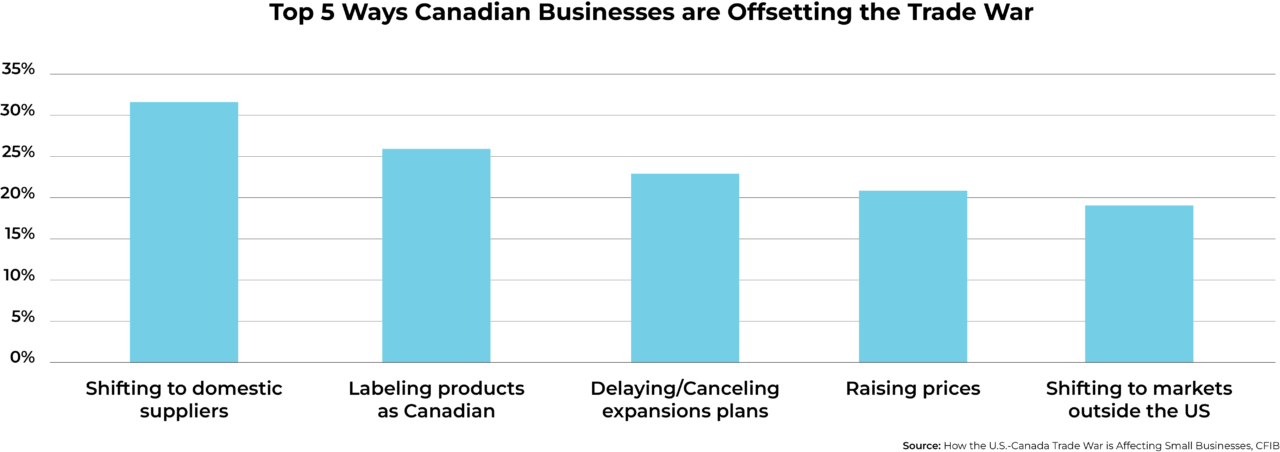

Sweeping tariffs levied by both the United States and Canada are reshaping North America’s trade relations, causing significant uncertainty.

After 50 years of relative trading stability, the Bank of Canada reported that trade policy uncertainty measures spiked to unprecedented levels in 2025 — increasing by more than 220% compared to Trump’s first term in office.

What this means for your business

The increased cost to export Canadian goods and import US goods is straining budgets and minimizing profits.

In addition, the trade war is contributing to supply chain disruptions, workforce downsizing, and lowering business confidence and investments.

How to protect your business

Navigating tariffs requires a multi-faceted risk mitigation strategy, and may include:

- Diversifying your supply chain

- Reevaluating contracts

- Absorbing costs and revising your pricing strategy

- Exploring government incentives

- Automating investments

- Forming strategic partnerships with logistics providers, financial institutions and trade groups

- Adjusting your procurement strategy

- Using financial instruments to mitigate the risks of exchange rate fluctuations

- Restructuring your operations to take advantage of free trade zones

- Expanding your domestic presence

- Leveraging trade agreements and alternative markets

- Investing in research and development

Learn more about these risk mitigation measures here.

Acera Insurance is in the business of protecting yours

These key learnings and strategies can help your business prepare for an evolving risk landscape shaped by natural disasters, rising costs, increasing cyber threats and shifts in the Canadian insurance market.

Contact an Acera Insurance advisor to discuss these insights further and to develop a proactive strategy that will help to safeguard your business and support your goals in the coming year.