Inflationary pressures, declining access to public healthcare, consistent increases in mental health challenges and economic instability will continue to put pressure on employee group benefit plans in 2026.

Acera Benefits consultants offer the following insights to help you navigate the ever-shifting health and wellness environment to support a healthier, happier and more productive team.

Rising costs

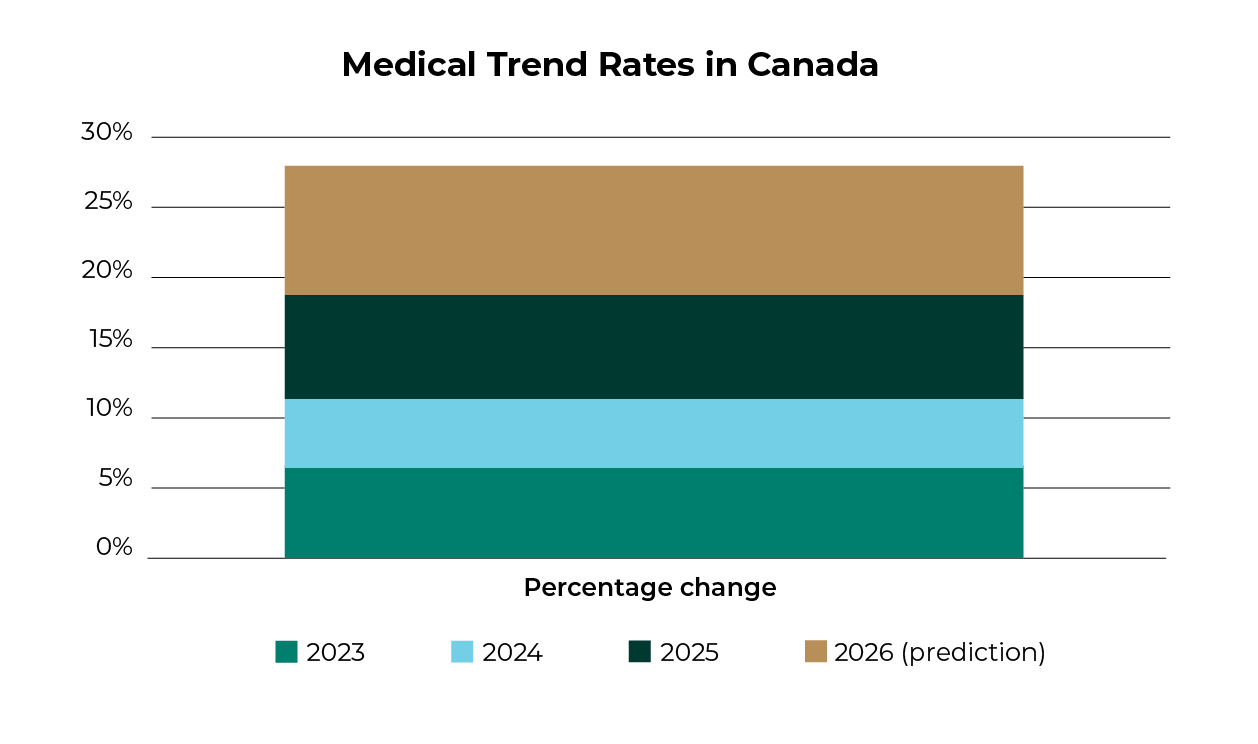

Medical trend rates — which calculate changes in medical costs based on factors like inflation, technological advancements and plan utilization — continue to increase year-over-year in Canada.

Two-thirds of surveyed Canadian employers have reported that the cost for their group plan has increased over the past year, crediting the cost hike to:

- Inflation

- Increase in drug costs

- Increase in prescription drug claims

- Higher dental service fees

Source: Global Medical Trend Rates Report (2024, 2025 and 2026), AON

Other contributing factors may include increasing claims for:

Paramedical & wellness services

When it comes to the benefits that employees utilize the most, three paramedical services — massage, physiotherapy and chiropractic services — land in the top five, along with drug and dental claims.

High-cost drugs to manage diabetes & weight loss

Diabetes is the fifth most commonly diagnosed chronic condition in Canadians over the age of 20, affecting nearly 10% of Canadians and another 6.3% who live with prediabetes.

On top of this, 65% of Canadians are considered either overweight or obese. Individuals who have been told by a doctor that they need to lose weight are increasingly interested in taking prescription medication to support this journey, with the majority of those saying they believe their benefits plan should cover most or all of the drug cost.

These statistics correlate with the steady growth in semaglutide — better known as Ozempic and Wegovy — for which prescriptions can cost up to $400 per month.

While 29% of diabetic Canadians are treated with GLP-1 agonists (like Ozempic and Wegovy), these high-cost drugs account for nearly 50% of total diabetes drug costs.

There has also been a significant spike in costs associated with weight loss medications, which increased by 170% in a five-year period.

How to manage rising costs

- Consider cost-sharing strategies, including flexible benefits where employees can choose to pay more to access broader coverage.

- Utilize co-pays and flex accounts (i.e., health spending accounts) to help employees balance necessity and consumerism.

- Ensure proper drug formularies are used, including the requirement of prior authorization.

- Educate your plan members on third-party drug programs that can support some of their out-of-pocket expenses.

- Review maximums, co-insurance and stop-loss thresholds with your Acera Benefits consultant.

- Prepare for the potential 2026 generic entry of semaglutide (Ozempic/Wegovy) in Canada by reviewing drug formularies with you Acera Benefits consultant.

Access to healthcare

Approximately 22% of Canadian adults do not have a family doctor. This lack of access to primary healthcare means roughly 6.5 million Canadians are more likely to:

- delay or forgo preventative care (i.e., screenings, vaccinations)

- be diagnosed late for chronic or serious illnesses

- face hospitalization for manageable conditions (i.e., diabetes, hypertension)

- face longer wait times due to the strain on after-hours care and emergency departments

But many of those who have a general physician struggle to regularly access primary care — more than 40% of surveyed plan members said they’re overdue to see their doctor.

Healthy employees are one of your most valuable assets.

Here are three ways that your benefits plan can support the health and wellbeing of your team in response to dwindling access to healthcare across Canada:

1. Provide a virtual healthcare option

Job demands, doctors’ schedules and primary care shortages are increasingly making it challenging for Canadians to secure an appointment with a physician.

Offering virtual healthcare as part of your group benefits plan can help your employees quickly connect with a licensed physician over a secure video call, phone call or messaging app, often 24 hours a day, seven days a week.

Virtual healthcare providers respond to an array of non-urgent general health and mental health conditions. They also typically offer navigational services, in which their teams can help patients line up in-person doctor, specialist and diagnostics appointments.

“Virtual healthcare products provide significant value to employees and have a tangible return on investment.”

Mike Sanderson

Regional Director, Acera Benefits

2. Offer an employee assistance program

An employee assistance program (EAP) can help individuals connect with trained professionals to start addressing the areas in which they’re struggling.

EAP providers typically offer confidential services, empowering employees to broadly and holistically explore possible solutions to their wellbeing — be it physical, emotional, mental or financial.

3. Develop an employee wellness program

Offering a benefits plan is no longer enough to satisfy a growing desire for more employer-led health initiatives.

Acera Benefits can help you develop a tailored wellness program that draws from a range of expertise and activities, including:

- mental health practitioners

- mindfulness coaches

- ergonomics

- team challenges

- nutritionists

- yoga

- fitness

- financial wellness

- resiliency workshops

84% of surveyed plan members want their employers to support their health and wellbeing beyond offering a benefits plan.

It’s important to note that providing virtual healthcare, an EAP and a wellness program is not enough. You must constantly raise awareness of and encourage your employees to utilize these tools so your team and your business can reap the benefits.

“If we can have employees utilizing virtual health and staff wellness programs, employers will begin to see a return on investment with healthier, happier employees.”

Josh Dahl

Benefits Consultant, Acera Benefits

Mental health

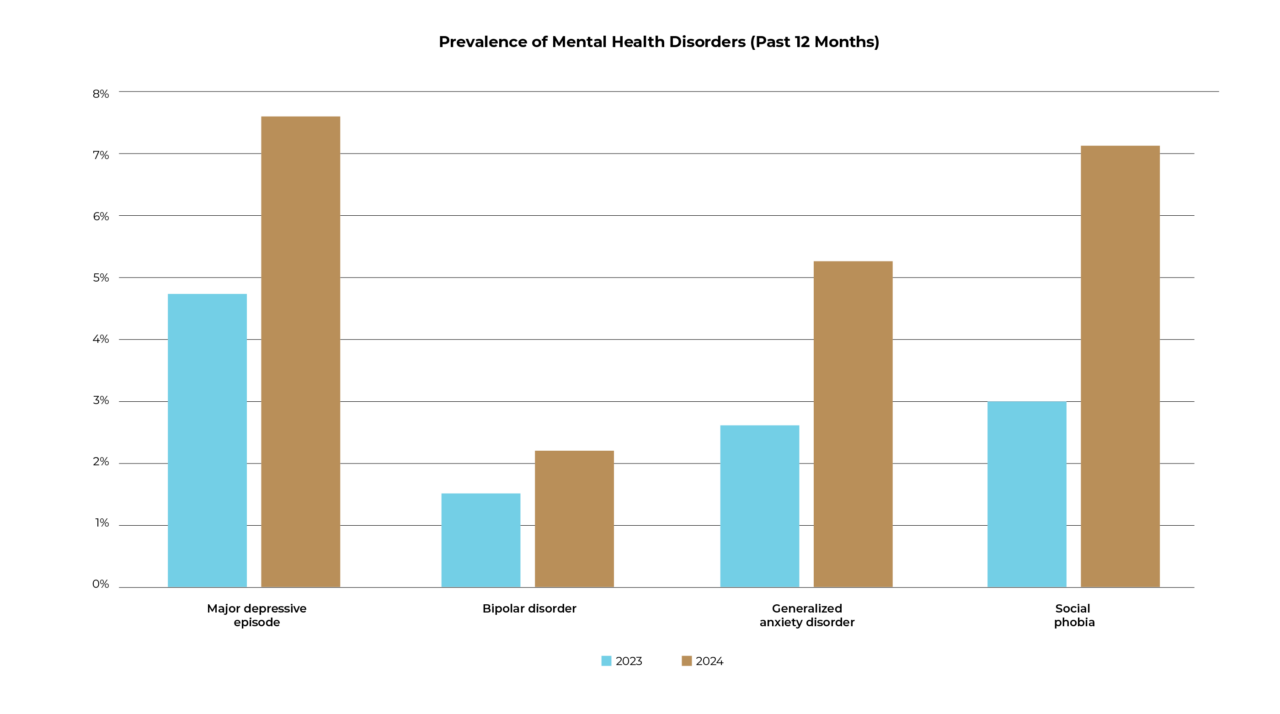

Mental health challenges continue to be of concern for Canadians.

The Canadian Mental Health Association reported that more than a quarter of Canadians considered their mental health to be “poor” or “fair” in recent years — a staggering increase from the pre-pandemic 2019 rate of 8.9%.

Statistics Canada also found significant increases over a 10-year period in the percentage of Canadians who met diagnostic criteria for select mental health disorders.

Source: Mental disorders and access to mental health care, Statistics Canada, Sept. 22, 2023

There was also a 25% increase in self-reported “poor mental health” among surveyed plan members between 2024 and 2025.

Perhaps unsurprisingly then, mental health diagnoses represented nearly 40% of long-term disability claims in 2024, an increase of 60% over 2019 rates.

How to respond to declining mental health

- Invest in greater mental health supports. A $500 per year combined limit is not sufficient to support your employees’ mental wellbeing. Ensure your mental health coverage cap is high enough to cover several counselling sessions (the Canadian Psychological Association says individuals struggling with depression or anxiety typically need 15 to 20 sessions to achieve therapeutic benefits).

- Offer an employee assistance program and prioritize mental health-specific initiatives as part of your organizational wellness program.

- Review your long-term disability program and return to work policies to ensure your employees can focus on the mental health treatment they need and then sustainably build momentum upon their return to work.

Retirement savings

The trade war and high rates of inflation exasperated financial stress among Canadians in 2025, with BMO reporting that rising prices have resulted in:

- 76% of Canadians worrying they won’t have enough money to retire.

- 63% of Canadians feeling unable to save for retirement.

In addition to the rising cost of living, increasing life expectancy is also impacting Canadian’s abilities to fund their retirement.

Here are two ways your business can respond:

1. Review investment lineup & behaviour

US administration decisions continue to impact the world economy, contributing to Canadians’ concerns around saving for retirement.

In response, review your investment lineup and members’ investment behaviours with your Acera Benefits consultant. Based on this review, your consultant can promote a well-diversified investment lineup to help navigate these times of economic uncertainty.

2. Factor longevity into savings plans

Life expectancy in Canada is 82 years.

For Canadians nearing retirement, this means careful decumulation strategies (the drawing down of savings to generate income in retirement) are paramount to avoid outliving their savings.

For younger Canadians, this means juggling competing financial pressures to start saving earlier in preparation for a lengthy retirement.

Support your employees in saving for retirement by working with your Acera Benefits consultant to:

- Utilize our customized employee sessions to educate your team on retirement income options and assist with important decumulation decisions.

- Review your plan design to ensure contributions are meaningful and in-service withdrawals are restricted.

- Promote participation in your group retirement savings program and support financial literacy among your employees.

“Younger employees have competing priorities for their paycheque but have the most to gain from starting to invest early in their retirement plan.”

Jackie Nicholls

Director, Group Retirement Services, Acera Benefits

A tailored approach to your employee benefits

These key learnings and strategies can help strengthen how your business supports employees who are facing increasing cost pressures, lack of access to primary healthcare and declining mental health.

Contact an Acera Benefits consultant to discuss these insights further and to enhance your plan for the benefit of your employee and your business in the coming year.

Sources:

- Benefits Canada – Healthcare Survey 2025

- Government of Canada – Prevalence of Chronic Diseases Among Canadian Adults

- Government of Canada – Diabetes in Canada: An Interactive Report on Key Statistics

- Government of Canada – Obesity Statistics in Canada: Report

- GreenShield – Drug Trends Report

- CBC – Massive New Survey Finds Widespread Frustrations with Access to Primary Health Care

- Canadian Mental Health Association – The State of Mental Health in Canada 2024

- Benefits and Pension Monitor – Mental Health is Now a Long-term Disability Issue, Sun Life Warns

- Sun Life – Changing Times: Evolving the Approach to Disability Management

- BMO – Retirement Survey: Over Three Quarters of Canadians Worry They Will Not Have Enough Retirement Savings Amid Inflation

Information and services provided by Acera Insurance, Acera Benefits and any other tradename and/or subsidiary or affiliate of Acera Insurance Services Ltd. (“Acera”), should not be considered legal, tax, or financial advice. While we strive to provide accurate and up-to-date information, we recommend consulting a qualified financial planner, lawyer, accountant, tax advisor or other professional for advice specific to your situation. Tax, employment, pension, disability and investment laws and regulations vary by jurisdiction and are subject to change. Acera is not responsible for any decisions made based on the information provided.

Get a quote.

Simply fill out a few details in our online form and one of our expert advisors will get your quote started.