Wood product manufacturers are often classified by insurers as high-hazard or high-risk businesses due to the history of significant losses in this sector. With total insured values that can exceed $100 million, securing property insurance can be a complex and challenging process.

The impact of being categorized this way is that there may be a lack of “capacity” in the market when attempting to place insurance. Insurers may only offer partial coverage, leaving you in the undesirable position of being underinsured.

What’s behind the shortage of insurance options for forestry and wood product manufacturing?

Despite a history of success, a mutual insurance company specializing in forestry and wood product manufacturing faced severe financial strain. Losses mounted due to catastrophic events, outpacing premium income being generated.

These pressures ultimately led to the company’s liquidation, leaving policyholders (particularly in Canada) with limited alternatives in the broader insurance market. The collapse underscored the challenges of managing niche risks in a volatile industry.

How lack of capacity affects forestry and wood product manufacturing businesses

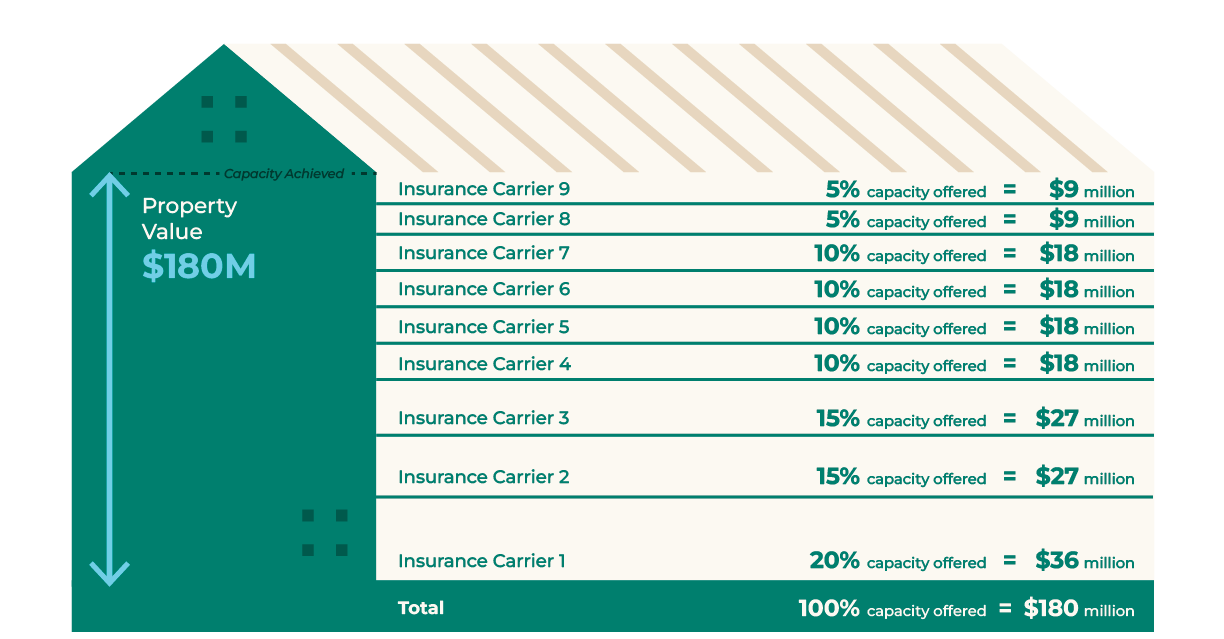

When there is a lack of capacity, insurers are unable to offer coverage up to the full value of property to be insured. Instead, they offer a percentage of the total limit. In this case, your broker must engage multiple insurers to participate in the full property placement.

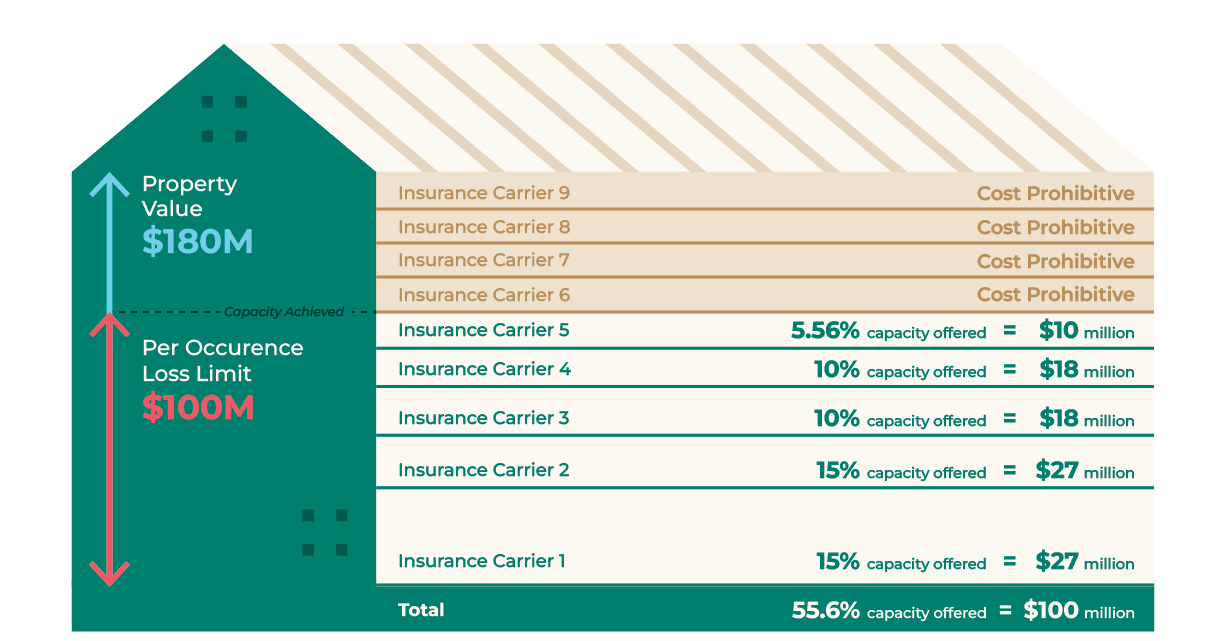

When full limits cannot be achieved, adding a “per-occurrence loss limit” to the property insurance terms and conditions may be your most cost-efficient option.

What is a per-occurrence loss limit?

A per-occurrence loss limit refers to the maximum amount paid out from a property insurance policy for claims arising out of any one event during the policy period. You may have multiple loss events that are not connected (i.e., a fire at the beginning of the year and a flood at the end of the year – two separate occurrences) that each have the same per-occurrence loss limit available.

Assume your business owns a $180 million plant, but the most your broker can secure in the insurance market is $100 million per occurrence. In response, your broker may patch together a “tower” of coverage with multiple insurers. However, if the market is tight, you may still fall short.

100% capacity achieved

$100 million per-occurrence loss limit

| Single site location values | $180,000,000 |

| Per-occurrence loss limit | $100,000,000 |

| Shortfall | $80,000,000 |

5 key drivers behind a per-occurrence loss limit being applied

Beyond capacity, there are several factors that contribute to why forestry and wood product manufacturing businesses may not secure full replacement coverage.

1. Tactical cost savings

Those aiming to minimize insurance spend may consciously accept more risk, choosing lower limits in return for lower premiums.

2. Risk quality

Poor risk management practices or inadequate documentation can make underwriters reluctant. If they can’t clearly understand and trust the risk, they’re less likely to offer full coverage.

3. Loss control evaluations capping coverage

Sometimes, third-party engineering reports determine probable loss scenarios. These findings might form the basis of a lower loss limit.

4. Brokers without specialized expertise

Complex property risks require brokers with specialized expertise. If your broker doesn’t deeply understand the nuances of this niche market, you could be leaving options and dollars on the table.

5. Hard-to-place property types

Certain properties are simply harder to insure. Earthquake zones, flood-prone regions, or high-value property and equipment in a single location tend to raise red flags for underwriters, making it harder to secure full coverage.

5 ways to improve your profile in the insurance market

Optimizing your risk profile is essential for securing favourable insurance terms and reducing overall risks. Here are five steps you can take to strengthen your position with insurers:

1. Invest in risk control.

Enhanced loss prevention can improve your risk profile and support your case for increased capacity from insurers.

2. Get updated engineering reports.

Annual reviews help ensure loss estimates reflect current conditions rather than outdated assumptions.

3. Partner with a specialized broker.

A broker with experience insuring complex property can tap into markets and strategies that generalists may miss or not be able to access.

4. Explore layered insurance structures.

Even if one insurer won’t take the full risk, a layered tower approach may still help you get closer to full coverage.

5. Quantify the exposure.

Understand the financial risk you’re accepting. Scenario modeling can help you make informed decisions on whether to insure, self-insure or seek alternative risk transfer solutions.

Stay a step ahead with Acera Insurance

Per-occurrence loss limits are becoming more common as insurers tighten their underwriting criteria to reduce their own exposure. That doesn’t mean you have to be caught off guard or settle for less.

At Acera Insurance, our advisors address these challenges with unique and innovative approaches towards navigating the insurance marketplace – including creative options you may have never seen. As specialists, we leverage our longstanding relationships with Canada’s leading insurers to bring you customized solutions with the broadest coverage at the best possible rates.

Will Downing is a Client Executive, Commercial Insurance, and Partner with Acera Insurance. He brings specialized expertise serving clients of all sizes in forestry and wood product manufacturing across Canada. Connect with Will at 250.869.6096 or will.downing@acera.ca.

Information and services provided by Acera Insurance, Acera Benefits and any other tradename and/or subsidiary or affiliate of Acera Insurance Services Ltd. (“Acera”), should not be considered legal, tax, or financial advice. While we strive to provide accurate and up-to-date information, we recommend consulting a qualified financial planner, lawyer, accountant, tax advisor or other professional for advice specific to your situation. Tax, employment, pension, disability and investment laws and regulations vary by jurisdiction and are subject to change. Acera is not responsible for any decisions made based on the information provided.