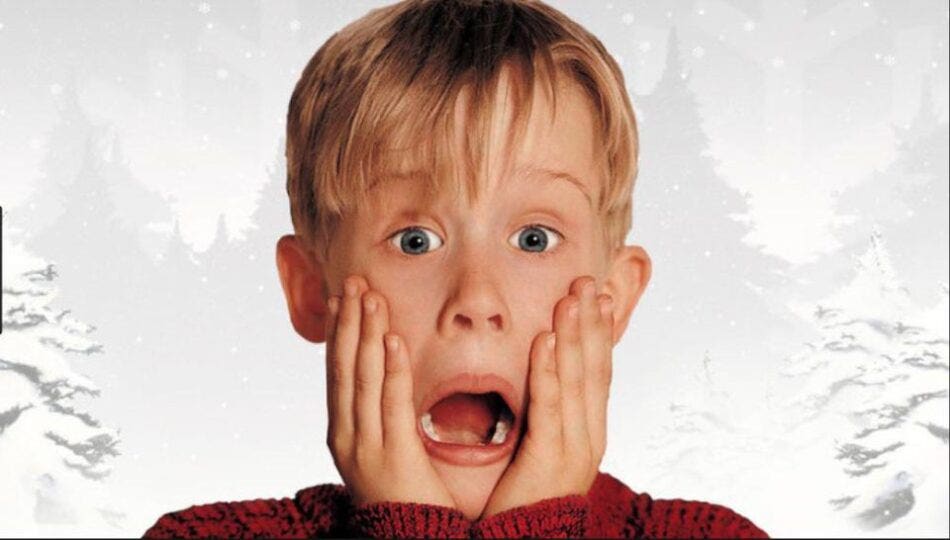

Have you ever wondered how much money Kevin’s antics in Home Alone cost the McAllisters? Are you curious about what damage in that movie would (or would not) have been covered by insurance? Then this is the blog post for you.

By special request (from my brother), we will break down what would and would not have been covered by insurance in Home Alone.

But first, a brief synopsis of the movie:

- A family (the McAllisters) goes to Paris for Christmas

- They forget their 8-year-old son (Kevin) at home in Chicago

- Their home is targeted by burglars (the Wet Bandits)

- Kevin tries to defend his home and himself against the burglars

- Lots of things and people get hurt in the process

Auto Collision with Statue

Early in the movie, a young pizza delivery driver crashes his car into a small statue in front of the McAllister home.

When there is a vehicle and a third party’s personal property involved, there will likely be two insurance policies covering damage.

The driver’s auto insurance policy should include liability (in B.C. all vehicles must have at least $200,000 coverage for Third Party Liability to cover damages to other parties and their property. This covers the driver’s expenses for damages if they collide with another vehicle, a pedestrian/cyclist, or the property of a third party, such as a fence or a small Grecian statue.

Normally, the owner of the damaged property would place a claim through their own home insurance to get the property repaired or replaced as soon as possible; then, their home insurance company would try to recover the payout from the responsible party (e.g. the driver).

If crashing into the statue damaged the car, the driver would claim this damage under their collision coverage.

In the case of Home Alone: The McAllisters could claim damage to the statue – caused by impact with an automobile – through their home insurance policy, pay their deductible, and get the statue repaired or replaced. The delivery driver’s insurance would cover damage to the car (if they have collision coverage) and damage to the statue under third party liability.

Uninsured Motorist Protection

As Kevin walks home after accidentally stealing a toothbrush, he is almost hit by a van. Had he been hit, the vehicle’s third party liability insurance would have covered his medical and related expenses.

However, when vehicles are used for illegal activities – say burglarizing a home and fleeing with stolen goods – the vehicle’s insurance is invalid.

To ensure you and your household members (including your 8-year-old son who was left home alone while you went to Paris) have coverage if you are hit by an uninsured or underinsured driver while you are walking down the street, riding your bicycle, or driving a vehicle yourself, purchase Excess Underinsured Motorist Protection (also called Excess UMP).

ICBC automatically includes $1,000,000 UMP on all auto insurance policies as part of the basic insurance package. $1,000,000 UMP is also provided to everyone with a valid B.C. driver’s license, whether or not they own or insure a vehicle.

Limits up to $5,000,000 can be purchased for an additional premium.

In the case of Home Alone: Had the van hit Kevin, the burglars likely would not have had insurance coverage, as their van was being used to commit crimes. To ensure they had coverage for Kevin’s medical expenses, Kevin’s parents would need to carry UMP coverage on their own automobile insurance policies.

Burglary/Theft

Burglary is a standard coverage included in almost all home insurance policies. For a home to be considered burglarized, there must be signs indicating unlawful entry/exit into the home, such as broken windows or doors. Burglary is covered regardless of whether anything from stolen from the home.

Without signs of forced entry/exit, missing items would be claimed under theft and mysterious disappearance coverage. Some policies have limited theft coverage, or none at all. Theft coverage is commonly removed when multiple unrelated individuals reside in the same home.

In the case of Home Alone: Burglary likely would not be covered at the McAllisters’ house since Kevin left the doors and windows unlocked and therefore there would be no signs of forced entry; however, had the burglars been successful in stealing items from the McAllisters, there would have been theft/mysterious disappearance coverage for those items. At the neighbours’ houses where the doors and windows were probably secured and the burglars would have forced their way in, there would be burglary coverage.

Note: Damage caused by attempted theft is automatically covered by most home insurance policies, so if the burglars hurt the house in their pursuits, but did not steal anything, there would still be coverage for that damage.

Flooded Basement

Flooding is complicated. To know whether a flooded basement is covered by your insurance you have to know the source of the water and the specific exclusions and coverage extensions in your policy.

Normally, a flooded basement caused by the bursting of pipes or a hot water tank or an overflowing laundry sink would be covered under a home insurance policy. The damage was caused suddenly and accidentally and was beyond the control of the homeowner.

If the pipes in your basement froze because you went on vacation (perhaps to Paris) and did not take care to maintain heat in the home or have someone check on the home (the exact requirements for this are in your home insurance policy wording, and can be explained to you by your home insurance broker), there would likely not be any coverage for the water damage to your basement.

Things get more complicated when the water in your basement came from the outside. Whether a drain backed up, or the nearby stream flooded and water rushed into your basement, outside water coming into your come may not be covered by your home insurance. A typical home insurance policy does not automatically include coverage for flooding nor sewer back-up; however, most insurance brokers will strongly urge you to purchase additional coverage for these risks.

In the case of Home Alone: The flooded basement would have been covered. Since the burglars, who call themselves the Wet Bandits, intentionally flooded the basement of the McAllisters’ neighbours after burglarizing their home, the insurance company may have considered the damage to be an act of vandalism, instead of water damage. Vandalism is a core coverage included in almost all home insurance policies (unless homes are vacant or under major construction). Likely, the insurance company would have settled the claim with the homeowners and then tried to recover the loss from the responsible party (the Wet Bandits).

Let’s hope the McAllisters – and their neighbours with the flooded basements and burglarized homes – were insured!

_______________________________

Morgan Thomas, BA

Team Leader, Personal Insurance Service Associates