Historical Perspective

Following the Industrial Revolution, businesses entered an era of globalization and expansion, driven by advances in transportation such as railways and motor vehicles. As employees for these companies travelled more frequently and encountered new exposures, the need for broader insurance solutions began to grow.

To address these evolving risks, insurers began to expand coverages beyond general liability policies. One of these extensions was non-owned auto coverage, which was designed to protect businesses from liabilities associated with vehicles they don’t own. Today, this coverage is a critical component of a well-rounded insurance program.

What Does Non-Owned Auto Insurance Cover?

Non-owned auto insurance coverage protects employers from liability when staff use vehicles that the company doesn’t own – such as employees’ personal vehicles, rental cars and vehicles used by contractors.

This coverage applies to third-party bodily injury or property damage resulting from an accident. However, it won’t cover damages to the vehicle being used by the employee or contractor.

Direct Liability vs. Vicarious Liability

There are two types of liability that are relevant to vehicle use:

- Direct liability applies when the organization is directly responsible for the vehicle involved in an incident.

Example: An employee is driving a corporate-owned truck to make a delivery to a client and gets into an at-fault accident. - Vicarious liability applies when an organization may be held responsible for the actions of individuals acting on its behalf.

Example: A board member rents a vehicle to attend a conference and is involved in an at-fault accident.

Understanding Who is Insured Under a Non-Owned Auto Policy

Unlike standard auto policies for owned vehicles, which typically cover anyone the insured allows to drive, non-owned auto policies are more restrictive in defining who is insured.

Coverage is commonly extended to:

- Council, commission or committee members.

- Trustees, board members, directors and officers.

- Partners, employees and volunteers.

Notably, spouses, children and personal acquaintances of these individuals are rarely covered. This highlights a key distinction between owned and non-owned auto policies.

Type of Coverage

Non-owned liability coverage typically includes:

- Liability – Covers third-party claims for bodily injury or property damage resulting from an incident involving a non-owned vehicle.

- Physical damage – May be added to cover damage to the non-owned vehicle itself but is typically not included.

Incorporation

Coverage Integration

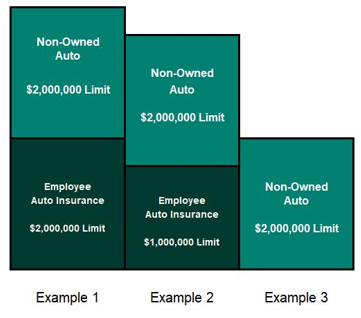

As we’ve discussed previously, the non-owned auto coverage relates to automobiles that employees drive, but how does this work? In the chart below, there are a few different examples outlined to bring clarity to the integration between employees’ personal coverage and the corporate non-owned auto coverage.

Non-owned auto coverage is always a secondary coverage, except if the employee’s primary coverage is absent (cancelled, lapsed, etc.) What this means is that the employee will always need to make their personal insurance claim and involve their auto insurers, and the corporate non-owned auto will respond where there are any shortfalls.

Example 1

The corporate non-owned auto coverage attaches at the employee’s $2-million limit.

Example 2

The corporate non-owned auto coverage is moving down to attach to the employee’s $1-million limit.

Example 3

The employee’s auto coverage is non-existent. What occurs (should corporate be named in a suit) is the non-owned auto coverage steps down as primary (liability only).

Employee Exposures vs. Corporate Exposures

In Example 3, if both the employee and third party suffer physical damage in a claim, non-owned auto coverage would respond only to the third party’s claim. Why? Because the employee opted not to carry their own insurance, any damage to their personal vehicle is not a corporate exposure. The vehicle is owned by the employee, and non-owned auto coverage applies only to liability arising from the use of non-owned vehicles — not damage to them. However, the third party can pursue the corporation for recovery, and the policy would also respond to any third-party injuries.

If an “insured person” (as previously defined) is using a rental vehicle and gets into an accident that results in physical damage to the rental, non-owned auto coverage may respond. This differs from a scenario involving an employee’s personal vehicle, which is not covered for physical damage. In the case of a rental, the vehicle is neither owned by the corporation nor the insured person, and the rental company could pursue the corporation for damages. Because of this potential liability, coverage is extended under the non-owned auto policy.

Corporate Exposures

Undoubtedly, there are corporate exposures that employees can bring into reality for all organizations. While this can’t be avoided, solid understanding of risks and proper mitigation are key. Corresponding insurance coverages ensure that organizations have risks covered properly.

Corporate Costs

The reality is that employees can cause organizations liability exposures. If the corporate insurance coverages are required to respond, there will be associated costs. Proactively understanding these exposures, coupled with corresponding risk management approaches, ensure organizations are well-positioned and understand these risks.

Initiatives & Considerations

Risk Management – Corporate approach to dealing with risk.

Best Practices – Standardization of requirements to deal with risk.

Consistency – Repeatability across all business sectors and employees.

Insurer Requirements – While insurers don’t require these practices to be implemented, they do assure organizations are proactively managing their risks.

Non-Owned Auto Claim Examples

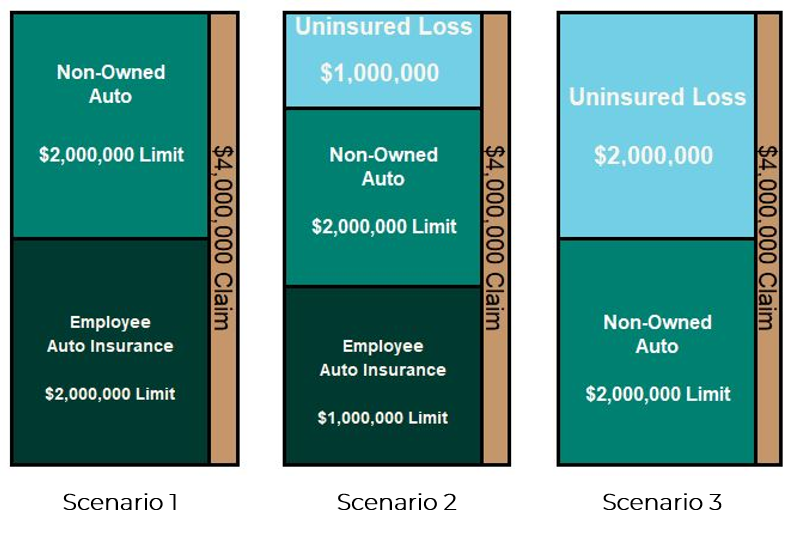

Claim Scenario 1

This scenario assumes a $4-million claim, a corporate non-owned auto limit of $2 million and that the employee’s personal vehicle carries a $2-million limit.

The claim is fully funded as there are enough collective limits.

Claim Scenario 2

This scenario assumes the same $4-million claim and $2-million non-owned auto limit. However, in this example, the employee’s personal vehicle is only carrying a $1-million limit.

There is a shortfall (uninsured loss) of $1 million as the claim total exceeds all collective limits.

Claim Scenario 3

This scenario assumes the same $4-million claim and $2-million non-owned auto limit. However, in this example, the employee’s personal vehicle has no coverage (lapsed, cancelled, etc).

In this scenario, there is a significant shortfall (uninsured loss) of $2 million as the non-owned auto is effectively acting as primary coverage.

Thoughts On Risk Mitigation

There are a variety of risk management steps organizations can take that include:

- Driver protocol acceptance

- Annual reminders

- Company vehicle standards

- Annual drivers abstracts

- Disclosure of all personal claims

- Rental vehicle protocols

Corporate Considerations

There are often opposing forces in managing risk; these often are ease of doing business and reducing risk. With this coverage, insurers typically don’t require organizations to implement the risk management practices for coverage to be provided. Rather, these are considerations that organizations choose to implement based on their risk tolerance and approach to risk.

All organizations should at least be aware of the potential risks. How they choose to implement risk management practices (if at all) will be unique to each organization.

Coverage Examples

Clients often find a variety of common scenarios within non-owned auto coverage. This chart illustrates common scenarios and the most common coverage applications. Ultimate coverage decisions are per the policy conditions and insurer/adjuster decisions. These are just general examples and do not consist of a guaranteed coverage by any insurer.

| Scenario | Covered | Not Covered |

|---|---|---|

| Administration staff uses vehicle to run errands for corporate (picking up mail, coffee/supply run, delivery). An at-fault accident happens and exceeds admin staff’s personal vehicle liability limits. | ||

| Board member (or volunteer) rents a vehicle to attend board meetings. They are involved in an at-fault accident and did not purchase the rental company insurance coverage. | ||

| Organization leases a short-term rental for business purposes. It was supposed to be returned after 30 days but was kept longer. NOTE: Non-owned auto only covers this up to 30 days and then it must be insured on an auto policy or returned and a new lease/rental completed. | ||

| Employee uses their personal vehicle for work (sales calls, business meetings, etc.). They accidentally did not renew their insurance and were involved in an at-fault accident. | ||

| Employee is involved in an at-fault accident while on their way to work driving their personal vehicle (prior to performing work duties or arriving at work). | ||

| Employee uses their own vehicle to attend work meetings/appointments. On their way to a work meeting, they are involved in a major at-fault accident which exceeds their personal auto liability limits. | ||

| Employee is using their own personal vehicle to travel to a work meeting. They are in an at-fault accident (and have valid personal insurance in place). The claim does not exceed their personal auto liability limits. Employee wants corporate to use their insurance to cover the claim. NOTE: Non-owned auto coverage is only secondary coverage to any available underlying primary insurance policy. The employee needs to use their own coverage for this incident. | ||

| Employee uses their own vehicle to attend a work meeting, they get in an at-fault accident, and they forgot to renew their personal insurance and/or it was cancelled/lapsed. Corporate is named in an injury claim due to the accident. NOTE: Employee’s physical damage to their own vehicle wouldn’t be covered as coverage was cancelled/lapsed, but corporate liabilities would be protected under non-owned auto. |

Good intentions and well-trained employees can still bring corporate exposures.

Contact your Acera Insurance advisor!

Joshua Friesen, B.A., CIP, is a Senior Client Executive and employee-owner at Acera Insurance with more than two decades of experience translating complex insurance challenges into clear, actionable strategies for organizations across Canada. A four-time Chairman’s Circle Award recipient, insurer “Top Broker,” and multiple Excellence Award honouree, he is celebrated for delivering measurable results and trusted advice. Josh has addressed over 100 industry forums as a keynote and seminar speaker, pairing technical expertise with an engaging, plain-language style that empowers leaders to make confident decisions. His sector insight spans a variety of industries ensuring bespoke, customized and personalized solutions are ensured as well as enabling him to tailor risk solutions to diverse operational profiles. Beyond brokerage, Josh has served on best-practice committees, mentors emerging professionals, and volunteers on community boards as well as recently appointed national sector leader demonstrating a deep commitment to service and stewardship. Clients value his credo of “turning complex to clear,” a relationship-first philosophy that consistently converts intricate policy language into clarity and confidence. When entrusted with your coverage, Josh combines seasoned insight, disciplined execution, and uncompromising advocacy to protect what matters most.

Connect with Josh at joshua.friesen@acera.ca or 403-998-8775.

Information and services provided by Acera Insurance, Acera Benefits and any other tradename and/or subsidiary or affiliate of Acera Insurance Services Ltd. (“Acera”), should not be considered legal, tax, or financial advice. While we strive to provide accurate and up-to-date information, we recommend consulting a qualified financial planner, lawyer, accountant, tax advisor or other professional for advice specific to your situation. Tax, employment, pension, disability and investment laws and regulations vary by jurisdiction and are subject to change. Acera is not responsible for any decisions made based on the information provided.