Water damage is one of the most common property insurance claims.

But insurers do not treat all water damage as equal.

Let’s take a closer look at what your property insurance policy may offer to protect you from several different types of water damage.

Basic water coverage

Property insurance typically covers damage caused by the sudden and accidental escape of water from something inside your home such as:

- burst interior pipe

- leaking appliance

- broken aquarium

(Pay special attention to the wording sudden and accidental as damage caused over time could result in a denied water claim.)

When it comes to water-related damage, property insurance has several exclusions — namely damage caused by water that enters your home from an exterior source, such as:

- rainwater

- flooded rivers

- sewer backups

- service lines

- groundwater

Fortunately, if you are eligible, you can extend your water coverage by adding the following endorsements to your policy.

Extend your water coverage: Overland water

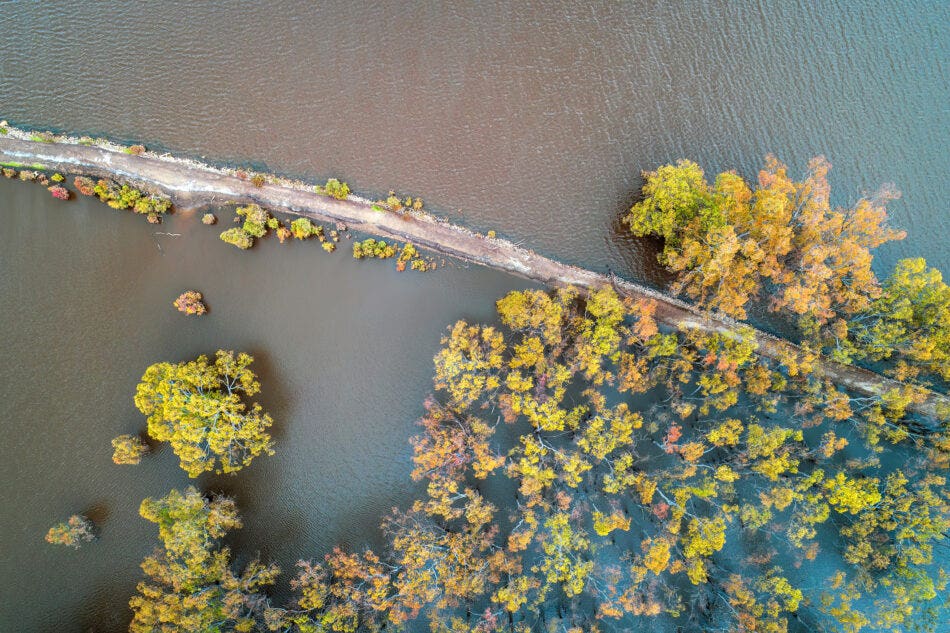

The term ‘overland water’ is what many outside the insurance world likely call flooding. But the protection that this endorsement offers is broader than damage caused by overflowing bodies of water.

Overland water coverage provides protection should your home be damaged when fresh water enters your property at or above ground surface after:

- a river or lake overflows its banks

- snow rapidly melts

- excessive rainfall

If you must temporarily relocate due to extensive overland water damage to your property or mandatory evacuation order (due to flooding), this endorsement can also provide coverage for additional living expenses.

Extend your water coverage: Sewer backup

Blockages, tree root intrusions, and sudden breakdown of sump pumps or septic tanks can force sewage back into your home through toilets, showers and/or floor drains.

In this case, only a sewer backup endorsement will cover the costs to clean, repair or replace your property and belongings.

If you must find alternative temporary housing while your home is being restored following wastewater damage, the sewer backup endorsement can also provide coverage for additional living expenses.

Extend your water coverage: Groundwater

The underground water table can rise significantly due to rapid snowmelt and heavy rain that are common in the spring and summer. When this happens, groundwater can enter your home suddenly and accidentally through a basement wall, foundation or floor.

Insurers are increasingly offering groundwater endorsements to provide protection should your property sustain water-related damage from natural underground sources.

This is different from overland water protection, which covers damage when water enters your home at ground level.

Extend your water coverage: Service line

Did you know homeowners are financially responsible for the underground service lines that run from the property line to their home?

In terms of water damage, service line coverage can help cover the costs to repair or replace your section of the sewer or water service line if they leak, break, tear, rupture or collapse.

In addition to repairs or replacements, the service line endorsement can help you cover:

- Excavation costs associated with unearthing the damaged service line.

- Additional living expenses if you’re unable to live at home while the service line is down.

- Costs to repair or replace your outdoor property (i.e., trees, plants, driveways) damaged due to the service line failure.

Ways to minimize water damage at home

- Install a backflow valve.

- Have an alarmed and battery-operated sump pump.

- Include water sensors in your home security package.

- Maintain your gutters and downspouts to prevent blockages.

Acera Insurance is your water wise partner

Water can damage your home in many ways — from floods and burst pipes, to sewage backups and more.

Contact an Acera Insurance advisor to discuss how you can enhance your water coverage at home.

Disclaimer: All policies have limitations, exclusions and conditions. Speak with your Acera Insurance advisor to learn more.