Hurricane preparedness guide: How to protect yourself from storm-related damage

Hurricane season in Canada is typically between June and November, often with peak storm activity being late August and September.

While the Atlantic provinces are most at risk for hurricanes and tropical storms, Ontario and Quebec can also be on the receiving end of severe wind and torrential rainfall from hurricanes moving across the eastern United States.

With sustained windspeeds between 117 km/h and upwards of 250 km/h, hurricanes can cause devastating property damage in a short period of time. Even lesser tropical storms — which are classified as having windspeeds between 62 and 116 km/h — can result in significant losses.

Acera Insurance does more than just offer coverage to protect against a variety of threats — we also educate and empower our clients to minimize risk.

Our hurricane preparedness guide provides information that can help you proactively minimize damage that a storm may cause to your home, business or farm. We also explain which insurance policies offer protection against hurricane-related losses and how to file an insurance claim.

Contents

- Protect your home from hurricanes

- Hurricane preparedness: Understanding what property and auto insurance covers

- Protect your business from hurricanes

- Hurricane preparedness: Understanding what business insurance covers

- Protect your farm from hurricanes

- Hurricane preparedness: Understanding what farm insurance covers

- Stay safe during a hurricane

- Hurricane damage: How to file an insurance claim

- Answers to your insurance questions about hurricanes

- Additional severe weather resources

Hurricane information for individuals

Protect your home from hurricanes

Hurricanes can cause property damage in several ways:

Widespread power outages can spoil food, which can ruin appliances like refrigerators and chest freezers.

- High winds and blowing debris can wreck roofs and siding, as well as break windows.

- Torrential rain and storm surges increase the likelihood of overland flooding.

- Widespread power outages can spoil food, which can ruin appliances like refrigerators and chest freezers.

While you can’t prevent a hurricane, you can take measures to protect your home and property from a storm. Here are some tips to help make your property more resilient to a hurricane’s severe winds, flying debris and significant rainfall:

- Keep your roof in good condition — make sure shingles are secure, as well as your eavestroughs and downspouts clean and in good repair.

- Check for blockages. Periodically inspect outdoor drains and ensure they are free of obstructions like leaves, branches or other yard debris.

- Secure loose exterior items or bring them inside. This includes items such as patio furniture, garbage cans, barbecues, bikes and toys.

- Protect your windows and glass doors. Ensure these are properly caulked or weather stripped and install impact-resistant storm shutters.

- Consider installing garage doors that are certified for high winds and impact.

- Trim and remove branches and trees that could fall on your house.

- Park your vehicle in a garage if you have one. Boats should also be stored undercover, if possible.

- Regularly maintain storm drains. If your home is near a storm drain, ensure it’s free of debris. Contact your municipality for maintenance if the storm drain is clogged or not functioning properly.

Make sure you have a current home inventory document — this should ideally be updated annually, at a minimum. Your home inventory can help the claims process go more smoothly if your home is damaged by a hurricane.

Your home inventory should document your possessions and belongings, including a detailed description, serial number, purchase date and estimated value. Keeping your receipts and taking photographs of your belongings — or a 360-degree-view video of your home — are also recommended.

Make sure to store your home inventory in a safe spot, including at least one copy offsite. Regularly back up digital copies.

Hurricane preparedness: Understanding what property & auto insurance covers

Homeowner insurance, condo insurance and tenant insurance policies typically provide coverage for some hurricane-related losses, such as:

- wind-related damage to your property and other structures (i.e., sheds, detached garages, fences), including destruction caused by flying debris and fallen trees or branches.

- water damage to your property and belongings if extreme wind suddenly causes an opening for the water to enter your home (i.e., flying debris breaking a window). You can also purchase additional coverages — known as endorsements — for sewer backups and localized flooding.

Homeowner insurance also typically includes coverage to remove any debris that has damaged your insured property and structures. For example, a fallen tree destroys your fence during a hurricane; the cost to remove the tree would likely be covered by your homeowner policy. But there would be no payout for debris removal if a tree fell and did not damage your insured property.

In addition to coverage for property damage, homeowner insurance, condo insurance and tenant insurance policies also often offer coverage for:

Food spoilage: This can help cover the cost of replacing the contents of your fridge and freezer if a hurricane causes a lengthy power outage.

Additional living expenses: If you must temporarily relocate while your home is being repaired following hurricane-related damage, additional living expenses coverage can help cover your increased living costs — expenses such as hotels, food and transportation. This coverage can also apply if you are forced from your home under a mandatory evacuation order. Keep all your receipts for expenses while you are displaced as your insurer will use these to calculate your extra costs, compared to your normal living expenses.

Significant rainfall and storm surges often accompany hurricanes, causing water damage.

Let’s break down the coverages available for water-related hurricane damage:

Sewer backups

Significant rainfall from a hurricane can cause sewers to back up into homes. Such damage may be covered if you purchased optional sewer backup coverage.

Overland water

Significant rainfall during a hurricane can cause localized flooding and the pooling water can seep into your home. Damage to your property and belongings in this case may be covered if you purchased optional overland water coverage. This includes coverage to replace food in your fridge, freezer and pantry that has been contaminated by floodwaters.

Storm surges

Damage caused by coastal flooding and storm surges are not covered.

How much will insurance cover if your property sustains damage during a hurricane? This depends on your coverage limit. The coverage limit is the maximum amount your insurer will pay for a covered claim, minus your deductible.

Let’s review the different property policy limits:

- Property coverage limit: This amount should reflect the cost it would take to repair or rebuild your home and additional structures (i.e., fence, detached garage, shed, deck).

- Contents limit: This amount should reflect the cost it would take to repair or replace your personal belongings (which should be captured in your home inventory list). Your content limit should also factor in additional living expenses.

- Food spoilage limit: Some insurers also include this limit, which should reflect the amount it will cost to replace the contents of your fridge, freezer and pantry.

An Acera Insurance advisor can help you determine adequate coverage limits based on your distinct needs.

You should also inform your broker of any upgrades, renovations and high-value purchases as these will have an impact on your coverage limits.

Homeowner insurance, condo insurance and tenant insurance all include a deductible. This is the amount you have agreed to cover when making an insurance claim, which will be deducted from your payout.

For example, let’s say your home sustains $2,500 worth of covered damage during a hurricane and your homeowner insurance policy has a deductible of $1,000. This means the maximum amount you will receive from your insurer is $1,500.

Your vehicle may be protected from hurricane-related wind and water damage — including storm surges — if you added optional comprehensive coverage to your auto insurance policy.

Auto insurance claims are also subject to policy limits and deductibles.

One of our brokers can answer questions you may have about how homeowner insurance, condo insurance, tenant insurance and auto insurance can provide protection in the event of a hurricane. Contact a member of our team.

Hurricane information for businesses

Protect your business from hurricanes

To protect your business from a hurricane, you must:

- Reduce the likelihood of property damage

- Have a plan in place to protect your employees

- Have a business continuity plan

Let’s explore these in more detail:

Proactively protect your business from a hurricane by taking action to minimize the potential damage that high winds, flying debris and severe rain may cause to your property.

- Ensure your structures (i.e., building, signs, flagpoles, fences) are secure and designed to withstand excessive windspeeds.

- Make sure your systems (i.e., mechanical, electrical, utility connections, water and sewer) are designed to withstand excessive windspeeds and adequately reinforced.

- Ensure any openings (i.e., windows, exterior doors, garage doors, skylights) are impact resistant. Also consider investing in storm shutters.

- Hire someone to trim back branches or remove trees that could damage your property if felled.

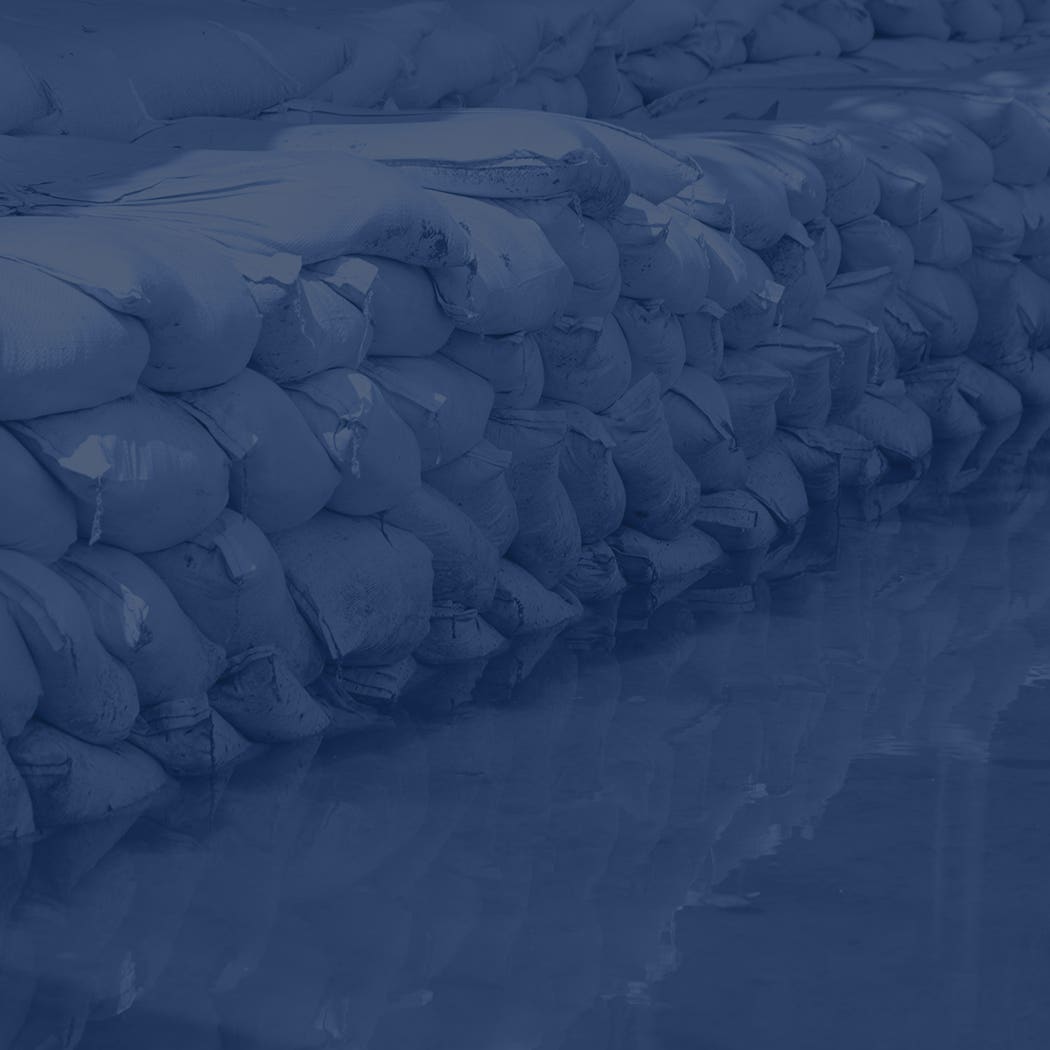

- Place sandbags or inflatable flood barriers around vulnerable drainage areas to help block excess water.

- Make sure key contents to your operations (i.e., computers, telephones, tools, machinery, inventory) are kept off the floor to mitigate possible water damage. This includes storing it on shelves or raised blocks.

Acera Insurance is your partner in risk management. Speak to a member of our team to determine how best to protect your business from hurricane-related damages.

Keeping your employees safe during a hurricane is of utmost importance.

Proactively educate and train your employees on your organization’s hurricane process. This should outline the steps they need to follow before, during and after a hurricane, and any evacuation or sheltering-in-place plans. Developing a crisis communications plan in advance of an emergency will empower your organization to coordinate a timely process for providing employees with the information they need.

You can find general tips for how to stay safe during a hurricane here.

A business continuity plan could be the key to your business’ survival following a hurricane.

The document should outline ways to maintain or quickly restore a certain level of operation, no matter if your business is directly or indirectly impacted by a hurricane.

Direct impacts include property damage, whereas indirect impacts include challenges such as lack of access due to mandatory evacuation orders or key suppliers losing critical supplies, resulting in shortages.

No matter the situation, a comprehensive business continuity plan can support your organization in quickly making necessary arrangements and adjustments to maintain some level of operation following a hurricane.

At a minimum, your business continuity plan should clearly outline how your organization will:

- Communicate with employees

- Set employees up to work in another location or remotely, if needed

- Manage supply chain logistics and potential shortages

- Maintain essential services and functions of your operations

- Access key data, systems and equipment

Hurricane preparedness: Understanding what business insurance covers

Commercial property insurance typically provides coverage for hurricane-related wind damage. This includes protection for your:

- Property, such as buildings, exterior signage, fencing and equipment.

- Contents, such as furniture, electronics and fixtures.

- Assets, such as inventory, tools and company-owned vehicles.

In addition to extreme winds, hurricanes also bring torrential rains, so it is important that businesses understand their coverage as it relates to water damage.

- Localized flooding: Intense rains can overwhelm storm drainage systems and cause pooling in low-laying areas. Damage caused to your business by localized flooding may be covered if you have purchased optional overland water coverage as part of your commercial property insurance.

- Sewer backups: Severe rains can cause sewers to back up into a business premises. Damage from this instance may be covered if you have purchased optional sewer backup coverage as part of your commercial property insurance.

- Coastal flooding and storm surges: In general, there is no commercial coverage available for damage caused by coastal flooding or storm surges.

- Business interruption insurance is critical coverage. This can help your business recover lost revenue if you suffer an insured loss (i.e., property damage) or if you’re forced to close due to a mandatory evacuation order during a hurricane.

- Commercial auto or fleet insurance can help repair or replace company vehicles damaged by hurricane-related winds or rains — but only if you have included optional comprehensive coverage as part of your policy.

Maintaining a current inventory list can support a more streamlined claims process in the event of an insured loss or damage.

This detailed list should outline your stock, products, contents and/or equipment. Take photographs (or 360-degree-view videos) inside and outside your business premises. Plus, keep all receipts and invoices for the items in your inventory.

This information will be pertinent when putting together your claim for repair or replacement costs.

Update your inventory list at least once a year and have multiple copies — including one you keep offsite. We also recommend that you provide a copy to your Acera Insurance advisor.

Hurricane information for farms

Protect your farm from hurricanes

- The extreme winds and torrential rains that accompany hurricanes can wreak havoc on a farm of any scale — from hobby farm to large-scale commercial operation.

- While you cannot stop a hurricane, you can proactively protect your farm to minimize potential damage from wind, flying debris and water.

- Remove any debris or loose objects from around your farm. This includes cleaning out culverts, ditches and other drainage areas.

- Securely fasten or anchor outdoor equipment, where possible.

- Install windows and doors that are impact resistant and consider investing in storm shutters.

- Trim away branches or remove trees that could blow onto your structures.

- Park your vehicles undercover, where possible.

- Inspect the roof on each building around your farm annually and repair or replace any damaged or worn materials.

- Clear all eavestroughs and downspouts, ensuring these drain at least two metres away from your building.

- Sandbag around your property, especially windows and doors, if safe to do so.

- Seal your well cap with plastic and duct tape.

- Install a sump pump, with a battery or generator backup.

Find more natural flood management tips for farms here.

Here are some tips to protect your livestock from hurricane winds and flying debris:

- Move your animals to a sheltered area, only if it is safe to do so.

- Never tie up or restrain animals who are outside.

- Remove loose objects from livestock areas.

Here are some tips to protect your livestock from hurricane-related flooding:

- Move animals away from low-lying areas, preferably undercover if possible. Keep all gates closed and ensure fencing is secure to prevent animals from moving to unsafe locations.

- Open gates that provide access to areas of higher ground so animals can move to safety if needed.

- Keep feed stored higher up where it is less likely to flood. Never feed your animals anything that has been contaminated by flood water.

- Ensure your animals’ vaccinations are current as diseases are often found after flood events.

Here are some general emergency preparedness tips to care for the wellbeing of your livestock:

- Make sure all your animals have some sort of visible identification (i.e., tattoos, ear tags).

- Provide plenty of food and water, and ensure you are stocked up on feed, hay and medical supplies. Ideally, you should have enough to last a week or two.

Remember, always prioritize your safety whenever a hurricane presents a direct risk. You can find general tips for how to stay safe during a hurricane here.

Hurricane preparedness: Understanding what farm insurance covers

The following insurance policies can provide farm coverage in the event of hurricane-related wind damage:

- Property insurance (i.e., homeowner insurance, commercial property insurance)

- Livestock insurance

- Crop insurance

- Business interruption insurance

- Comprehensive coverage as part of your auto policy

As far as water-related hurricane damage is concerned, you can protect your farm from:

- Localized flooding by purchasing overland water coverage.

- Sewer backups by purchasing sewer backup coverage.

Coverage is not available for coastal flooding or storm surges.

Staying safe during a hurricane

- Stay informed and be prepared to evacuate.

- The main floor of your home is the safest space to stay during a hurricane. This is because the fierce winds can tear the roof off, exposing upper levels to the elements, and a basement can flood.

- If seeking shelter or told to evacuate, avoid flooded roadways and paths, as well as washed-out bridges.

- Stay away from the shoreline and do not go out on a boat. If you are out on the water, head for the shore as soon as you see dangerous weather approaching.

As hurricanes bring significant rainfall, we also recommend you review our tips for how to stay safe during flooding.

Dangers are often still present after a hurricane passes.

- Stay tuned in to the latest news and updates from local authorities.

- Rain often continues after the eye of the storm passes. Be aware of and prepared for flooding, as well as other secondary disasters such as landslides.

- Avoid downed power lines and damaged areas.

- Ensure your home is safe before re-entering. When in doubt, stay out until you can have a professional assess the structure.

- Do not use any water or food that may have been contaminated. Review these tips for how to safely return home after floodwater damage.

Hurricane damage: How to file an insurance claim

Follow these steps if you have experienced hurricane-related damage or loss:

- Contact us at your earliest convenience. We will help support you through the entire claims process.

- Take photographs and detailed notes to document the damage once it is safe to do so.

- Keep all your receipts for cleanup, repairs, replacements and temporary extra living expenses.

You can also find answers to common claims questions here.

Answers to your insurance questions about hurricanes

Canada faces an average of six tropical storms a year, some of which are hurricane strength, according to the Government of Canada.

Bringing significant winds and rain, a hurricane can quickly cause a wake of destruction. In fact, Hurricane Fiona, which struck the east coast in 2022, caused $660 million in insured damage, making it the costliest severe weather event ever recorded in Atlantic Canada, according to the Insurance Bureau of Canada.

There is no such thing as ‘hurricane insurance.’ This is because damage caused by a hurricane’s extreme wind and torrential rainfall are commonly covered under property insurance.

For example, wind is a covered risk in the following property policies:

- Homeowner insurance

- Condo insurance

- Tenant insurance

- Commercial property insurance

You may also choose to enhance your property policy by purchasing optional coverages for sewer backups and overland water damage.

In this case, you would likely not be responsible for any damage caused by a tree during a major windstorm. This is because you are not responsible for the downed tree; the hurricane winds are what caused it to fall.

In general, property owners will only be held liable for damage caused by a fallen tree if negligence was a factor. For example, ignoring a rotten tree for a period of time before it falls over and damages property.

As a tenant, you are responsible for covering your personal property and possessions (i.e., clothing, electronics, furniture) — this is what is covered under a tenant insurance policy.

Your landlord is responsible for responding to any damage the physical building may sustain during a hurricane.

If it is unsafe for you to reside in your rental due to hurricane-related wind damage, your tenant insurance will provide additional living expenses to help offset the cost to temporarily reside elsewhere. If your rental was damaged by the sudden accumulation of rainfall during the hurricane, you will need to have purchased overland water and/or sewer backup coverage to claim additional living expenses.

Business interruption insurance typically excludes losses resulting from power outages due to damaged electrical transmission lines.

In the case of a hurricane, business interruption coverage will typically respond if your business is temporarily unable to operate due to:

- Direct physical damage to your premises or key equipment and machinery.

- Supply chain issue resulting from a vendor sustaining hurricane-related damage.

- Mandatory evacuation orders that prevent you from operating.

Additional severe weather resources

Flood preparedness guide

Learn how to insure your home and business against flooding and how to minimize flood damage.

Wildfire preparedness guide

Learn how to insure your home and business against wildfires and how to minimize damage caused by these blazes.

Earthquake preparedness guide

Learn how to insure your home, business or farm against earthquakes and how to minimize damage caused by these tremors.

Tornado preparedness guide

Learn how to insure your home, business or farm against tornadoes and how to minimize damage caused by twisters.

Hail preparedness guide

Learn how to insure your home, business or farm against hail and how to minimize damage caused by hailstones.