’Tis the season for hosting family and friends. While planning the menu and décor may be top of mind, precautions must also be taken to ensure everyone makes it home safely. All it takes is one incident during or after your party to be pulled into a lawsuit — and for high-net-worth hosts, the stakes include significant assets.

As a member of our Signature by Acera Insurance team, Tonia Tagoe, Client Executive, shares how affluent Canadians can best protect their guests, their communities and themselves while enjoying the season’s festivities. Read on for our ultimate liability guide for hosting holiday parties at home.

Understanding the liabilities of hosting a holiday party at home

Joy may abound during the holiday season, but we still live in a litigious society.

That’s why hosting a holiday party — particularly one where alcohol is served — presents significant liability risks.

For example:

- A guest could slip on your icy front doorsteps and injure themselves in a fall.

- A guest may cause damage to your neighbour’s property when leaving your party.

- You could unwillingly serve improperly prepared food and many of your guests might experience severe food poisoning.

- An intoxicated guest could drive away from your party and crash into another vehicle, resulting in injury or even death.

Just one incident tied to your holiday party is all it takes to be pulled into a lawsuit.

Your holiday hosting safety net: Why high-net-worth individuals need excess liability insurance

Your home insurance provides third-party liability coverage; however, your wealth makes you a prime target for lawsuits demanding large sums for damages.

To put it bluntly: the more assets you have, the more the courts will award.

Even if the claim put against you is unfounded, you still must defend yourself to protect your reputation and livelihood. Escalating legal fees and drawn-out lawsuits alone can quickly drain your home insurance limit for liability coverage.

That’s where personal excess liability insurance comes in.

Excess liability insurance — also known as umbrella insurance — provides an additional financial safety net over and above your other policies, such as home insurance, auto insurance and boat insurance. Excess liability kicks in once the liability limit on your other policy has been exhausted.

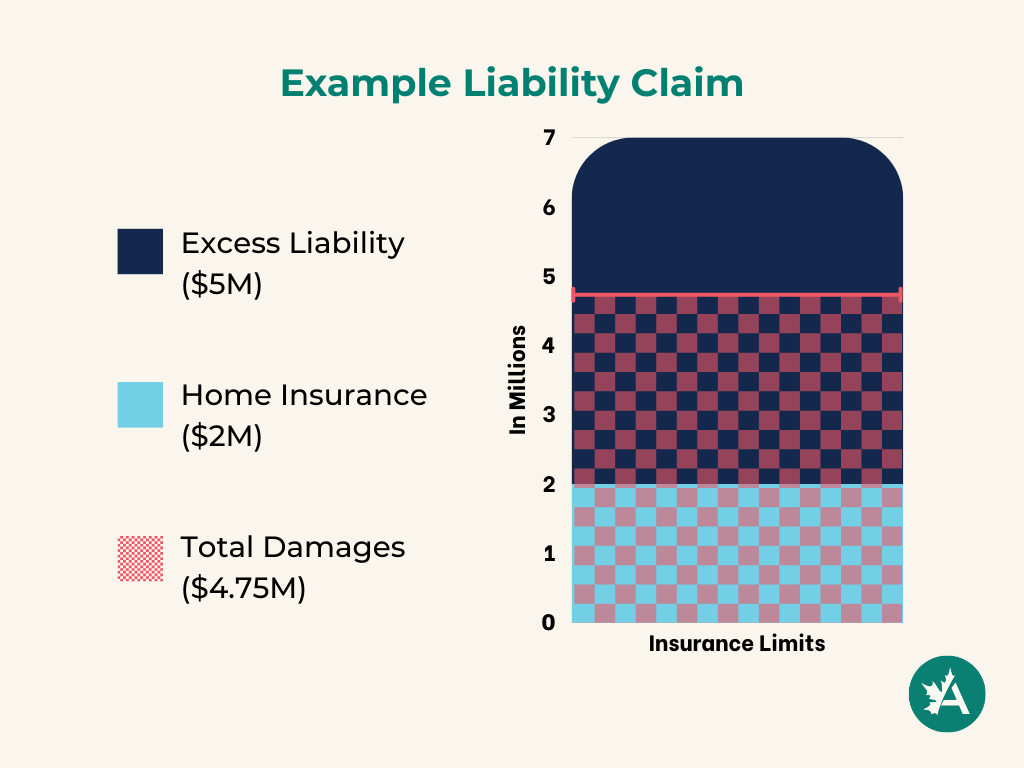

Let’s use an example to illustrate how excess liability insurance works.

Say your home insurance third-party liability limit is $2 million. You also have an excess liability limit of $5 million.

A guest falls and hits their head at your holiday party, resulting in serious injuries. They sue and the courts find you liable for the incident, awarding $4 million in damages. In addition to this, you have racked up $750,000 in legal fees. Your home insurance liability limit would first be maxed out. Then your excess liability insurance policy would cover the remaining $2.75 million.

Your holiday party checklist: 5 ways to ensure guest safety and limit your liability

As a host and property owner, you have a duty of care to your party guests.

Adding the following items to your party planning to-do list will ensure you provide a warm, welcoming and safe environment for your guests this holiday season — and also demonstrate your due diligence as a responsible host in case you’re named in a lawsuit.

1. Make sure your home is well-maintained

Winter and inebriation — two conditions that can easily lead to slips and falls around your home. There are also other potential hazards around your house that could lead to personal injury.

Here are seven ways to prepare your home when hosting a holiday party:

- Clear snow and ice from driveways, sidewalks and steps.

- Ensure adequate outdoor lighting for pathways and entryways.

- Secure rugs and mats.

- Clear objects from hallways and stairs.

- Keep your pets in a separate room.

- Block access to risky areas, like pools, hot tubs and balconies.

- Reduce fire hazards: use battery-operated candles, ensure your fireplace is safe for use and do not overload electrical circuits.

2. Hire trained bartenders

Hiring a bartender isn’t just about mixing cocktails. It’s about ensuring safe alcohol consumption, which will help keep your guests safe and reduce your liability.

Look to hire bartenders who have completed provincial training programs, such as Smart Serve in Ontario, ProServe in Alberta and Serving It Right in BC. These programs teach bartenders how to spot signs of intoxication, how to calmly and professionally refuse service to intoxicated guests, and how to prevent underage drinking.

All these skills go a long way in reducing the risk of overservice and alcohol-related incidents.

3. Serve food and offer non-alcoholic options

Delicious food and a range of beverages to choose from make every holiday party more enjoyable.

It also goes a long way in minimizing intoxication and alcohol-related accidents.

4. Arrange safe transportation

Impaired driving remains one of the top contributing factors in fatal collisions across Canada, according to Statistics Canada.

Providing your guests with a safe ride home can help ensure your joyous festivities do not end in tragedy.

Consider partnering with a local car service provider or a rideshare company and communicate these transportation options with your guests before and during your holiday party.

5. Obtain proof of insurance from vendors

When hiring bartenders, caterers and other vendors to work your holiday party, ask them to provide proof of insurance. You want to ensure they have adequate coverage in the event their negligence causes harm to your guests (i.e., overserving alcohol, food poisoning).

Just remember, you can be named in a lawsuit along with the vendor, underscoring the need for you to have your own excess liability insurance.

Host a safe and memorable holiday party this year

Holiday parties can be unpredictable.

With excess liability insurance, you can focus on entertaining your guests with peace of mind.

And, with the five proactive risk mitigation strategies outlined above, you will elevate the enjoyment for all your party guests and safeguard your assets and reputation.

Happy hosting!

FAQs: An overview of personal excess liability insurance

The limit you need depends on your assets and risk exposure. The greater the number and value of your assets, the higher the limit you’ll want for personal excess liability insurance.

At a minimum, high-net-worth Canadians should have $5 million in excess liability. But this is just a starting point. With more significant assets, you may need $10 million, $25 million or more in coverage.

Speak with an advisor on our Signature by Acera Insurance team to get expert guidance on the excess liability protection you need.

Yes, personal excess liability coverage will often extend to your secondary or vacation properties, so long as you meet minimum underlying limits on your primary policy.

Elite excess liability insurance policies for high-net-worth individuals and families can even provide global coverage.

Depending on the type, scale and location of your gathering, you may want to consider additional event-specific policies. This is to protect your own personal insurability. Should a claim arise, the event policy would respond first, preserving your personal insurance policy.

Speak with a Signature by Acera Insurance advisor to discuss the coverage that is best suited for your event.

Related reading:

- Protecting your holiday gifts: Home insurance tips for high-value items

- How to optimize your insurability as a high-net-worth individual

- Protecting your reputation in a digital age: Cyber response strategies for wealthy Canadians

With 20 years of experience, including 13 in high-net-worth markets, Tonia Tagoe, Client Executive, brings extensive knowledge to her clients, providing top-tier service. She thrives on the variety of interesting challenges that come across her desk, finding passion in solving complex problems. Tonia earned her Registered Insurance Brokers of Ontario (RIBO) designation in 2006 and holds a Canadian Accredited Insurance Broker (CAIB) Level 1 certification.

You can contact Tonia at tonia@tagoe@acera.ca or 905.456.5190.

Get weekly tips to protect your business!

Subscribe to our LinkedIn Newsletter. Our advisors’ insights will help you Be Risk Ready.

Information and services provided by Acera Insurance, Acera Benefits and any other tradename and/or subsidiary or affiliate of Acera Insurance Services Ltd. (“Acera”), should not be considered legal, tax, or financial advice. While we strive to provide accurate and up-to-date information, we recommend consulting a qualified financial planner, lawyer, accountant, tax advisor or other professional for advice specific to your situation. Tax, employment, pension, disability and investment laws and regulations vary by jurisdiction and are subject to change. Acera is not responsible for any decisions made based on the information provided.

Get a quote.

Simply fill out a few details in our online form and one of our expert advisors will get your quote started.