The advantages of helping employees manage their health and wellbeing are clear. Offering group benefits can:

- Improve employee morale and loyalty

- Reduce absenteeism and increase productivity

- Attract and retain top talent

While many employers are motivated to offer a competitive benefits plan, concerns abound with doing so in a sustainable fashion.

Let’s examine how Acera Benefits can help you navigate escalating costs — for both you and your employees — while providing a holistic plan that aligns with an evolving health and wellness environment.

Modern Risks to Traditional Prescription Drug Plans

According to the 2024 Benefits Canada Healthcare Survey, plan sponsors list overall cost management as their primary challenge, with nearly one third identifying drug cost management as a particular concern.

Perhaps this is why nearly 30% of surveyed plan sponsors said they expected to reduce or remove coverage under their drug plan — whereas coverage increases were commonplace for mental health, paramedical, dental, vision and disability benefits.

Traditional efforts to curb drug costs include:

- Prior authorization, which requires insurer approval for certain prescriptions.

- Step therapy, which requires employees to try effective, affordable treatments before covering pricier prescriptions.

- Reimbursing the lowest price biosimilar instead of higher-cost biologic drugs.

But these cost-saving measures can prove less effective for new drugs and new therapeutic indicators for existing drugs, which are introduced each year. This is largely due to patents and insurer processes around prior authorization and step therapy.

For example, Health Canada approved Ozempic in 2018 for the treatment of Type 2 diabetes. But major insurers didn’t implement prior authorization until 2023. This means the drug was covered under plans for both its intended use and notorious off-label weight loss prescription for five years. As a result, the key molecule in Ozempic topped the Telus Top 10 Covered Drug Molecules list in 2023.

Are You Missing These Opportunities to Save on Your Drug Plan?

Acera Benefits partners with Cloud Advisors, a firm that benchmarks employee benefits trends across all industries, regions and sizes. From a sample of 14,000 Canadian employers, Cloud Advisors found:

- 80% do not have an annual maximum on their prescription drug benefit.

- 86% have an open formulary, meaning the plan covers any drug that requires a prescription.

- 90% do not have access to a preferred pharmacy network to help lower costs of drug and dispensing fees.

- 96% have generic substitution, but only 60% make this mandatory.

- 72% of plans are fully funded by the employer.

Modernize Your Employee Benefits Plan

If your company has not modernized your benefits plan over the past three years, your company could be falling behind your competition. Here are three ways your Acera Benefits consultant can help your organization manage drug and other group benefits costs:

Routinely evaluate your risk tolerance and plan sustainability to challenge the status quo of plan design.

Prioritize prevention by integrating wellness initiatives that complement your core plan. Acera Benefits offers customized wellness solutions that positively impact your team, which in turn benefits your organization.

Utilize benchmarking tools to develop short- and long-term strategies. This will ensure you achieve the desired outcomes for your plan while meeting market needs to remain competitive in the attraction and retention of employees.

Create a customized plan to meet the changing needs of your organization’s demographics. This is important as the workforce is increasingly comprised of multiple generations.

Rising Costs Eroding Group Benefits Coverage

Employee benefit plans are not immune to ever-increasing costs. Employers and employees alike are left grappling with how best to manage inflationary pressures. Where health benefits are concerned, this includes consistent cost hikes for the two most utilized plan components:

- Prescription drugs

- Paramedical services — particularly massage therapy, physiotherapy and chiropractic services

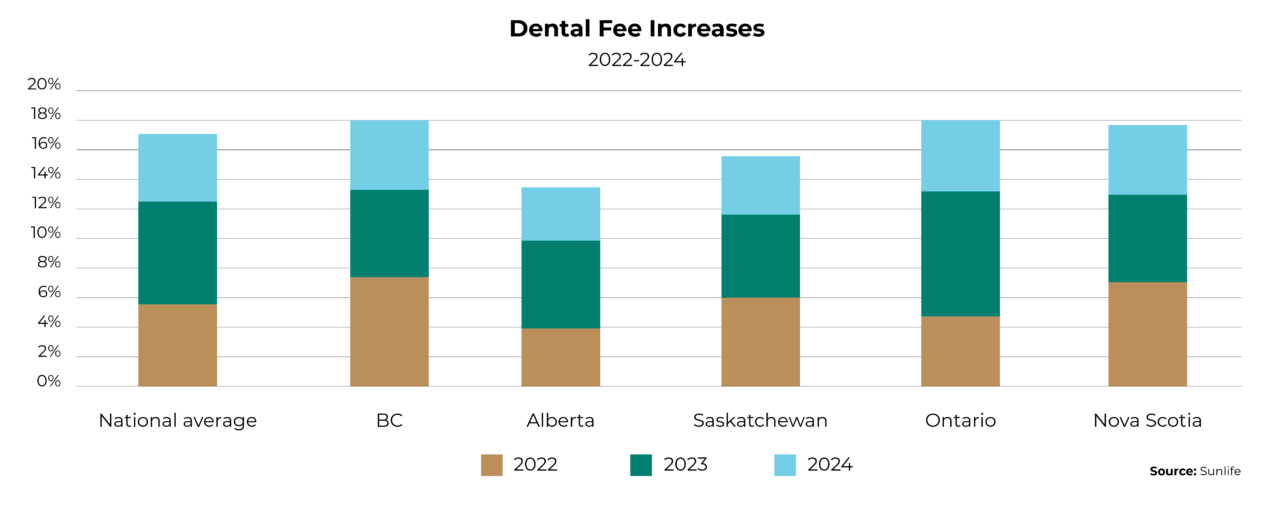

Ongoing dental fee hikes also limit how far this coverage can be stretched.

2024 Out-Of-Pocket Expenses

On average, plan members paid:

- $1,057 for dental services

- $1,032 for physiotherapy

- $992 for prescription drugs

- $925 for chiropractic services

- $821 for massage therapy

Source: 2024 Benefits Canada Healthcare Survey

In response to price escalation, many employers are considering offloading more costs to employees to help keep their health plans sustainable. And employees are increasingly either:

- Demanding more from their benefits plan — particularly increased coverage for dental services, vision care and paramedical services.

- Asking to opt out of their benefits plan to help reduce their personal financial pressures.

Cutting benefits from your plan will disadvantage your company in a tight labour market. Fortunately, there are options to create greater flexibility and choice for employees with the proper planning and guidance from an Acera Benefits consultant.

Stretch Your Group Benefits Plan

Here are four ways your Acera Benefits consultant can help maximize your plan:

Conduct a full plan design review. This process will unveil plan utilization trends, including underutilization; determine if maximum annual limits align with current costs; and survey your employees to learn what is most important to them.

Reallocate premium dollars to achieve better results for eligible employees.

Determine the feasibility for implementing self-insuring portions, such as dental, short-term disability and extended health care.

Establish spending accounts to supplement traditional coinsurance levels. For example, you can offset any decreases to co-insurance levels with a health spending account.

Supporting Employees’ Transition into Retirement

A lot of attention is given to saving for retirement — but financial accumulation is only part of the retirement equation.

The other factor is decumulation, or the drawing down of savings to generate income in retirement.

Withdrawing money sounds simple. In reality, this phase of retirement is complex with many considerations. This includes:

Longevity: Longer life expectancies mean retirees must carefully consider decumulation strategies to avoid outliving their savings.

Market volatility: Retirees must have a plan in place to ensure their savings can withstand financial downturns.

CPP collection: Retirees must balance immediate needs with long-term retirement income goals. Delaying CPP collection can result in larger payments.

Interest rates and inflation: Inflation drives up costs while interest rates affect income amounts. This underscores why retirees must carefully plan their decumulation strategy.

Leaving a legacy: Retirees must balance their needs with their desires to leave an inheritance or charitable gift.

Estate tax planning: Thoughtful planning can help retirees manage decumulation to minimize potential tax burdens placed on their beneficiaries.

81.7 years

Average Canadian life expectancy.

8.4%

The amount CPP payments increase for each year you delay after age 65.

65

The average retirement age in Canada.

2031

The year that the youngest Baby Boomers will turn 65.

Holistically supporting your team’s financial wellbeing includes offering a group retirement savings option and providing them with the right guidance to smoothly transition into retirement. Doing so not only supports your team members’ financial security, but also fosters loyalty, engagement and trust in the workplace.

Educate Your Plan Members

Here are three ways that your Acera Benefits consultant can help your business better support employees who are nearing retirement:

Utilize age banding information to identify plan members who are nearing average retirement age.

Invite this group to information sessions that address pertinent retirement topics, including decumulation.

Provide useful resources and tools to support these employees in doing their own retirement research and planning.

A Tailored Approach to Your Employee Benefits

Acera Benefits will support your business in designing and administering a meaningful and competitive benefits plan that addresses the unique requirements of your organization and employees.

Let’s discuss what we can do for you.