In 2026, geopolitical risk isn’t a periodic external shock. It’s embedded, showing up as policy constraint and correlated disruption across supply chains, cyber, contracts, capital and governance.

In part one, Aliya Daya, Senior Client Executive, Commercial Insurance, explained why geopolitics is an embedded business risk. Now, drawing from 25 years’ experience advising businesses on insurance and risk management, Aliya breaks down how to integrate geopolitics into enterprise risk management (ERM), replace forecasting with scenario architecture and design controls for effective geopolitical risk management.

Note: This is part two of a three-part series on how to manage geopolitical risk in 2026.

The first part of this series made the case for reclassification: geopolitical risk isn’t a periodic external shock anymore – it’s embedded.

It shows up as policy, constraint and correlated disruption across supply chains, cyber, contracts, capital and governance. The World Economic Forum’s risk framing supports this “systems” view: geopolitics and geoeconomics are increasingly interlinked with economic, technological and societal risk pathways rather than existing as a standalone category.

This second article is about what to do with that reality. Not in the “read more headlines” way, but in the “build a repeatable operating discipline” way.

Effective geopolitical risk management requires integration into ERM, decision-making and governance, with stress testing and control design that matches how geopolitical events actually transmit into loss outcomes.

This is also where Canadian organizations have an advantage: we’re used to operating in a rule-dense environment (cross-border trade, regulated financial markets, privacy / security expectations).

The goal is to turn that institutional muscle into decision readiness, so geopolitics becomes measurable, governable and insurable where appropriate.

Integrating geopolitical risk into ERM

The first step is structural: geopolitical risk needs to be explicitly recognized within enterprise risk management (ERM), not treated as “context.” The WEF’s approach to interconnected risks and the emphasis on scenario planning over linear prediction reinforces why ERM integration matters.

Practical ERM integration for geopolitical risk

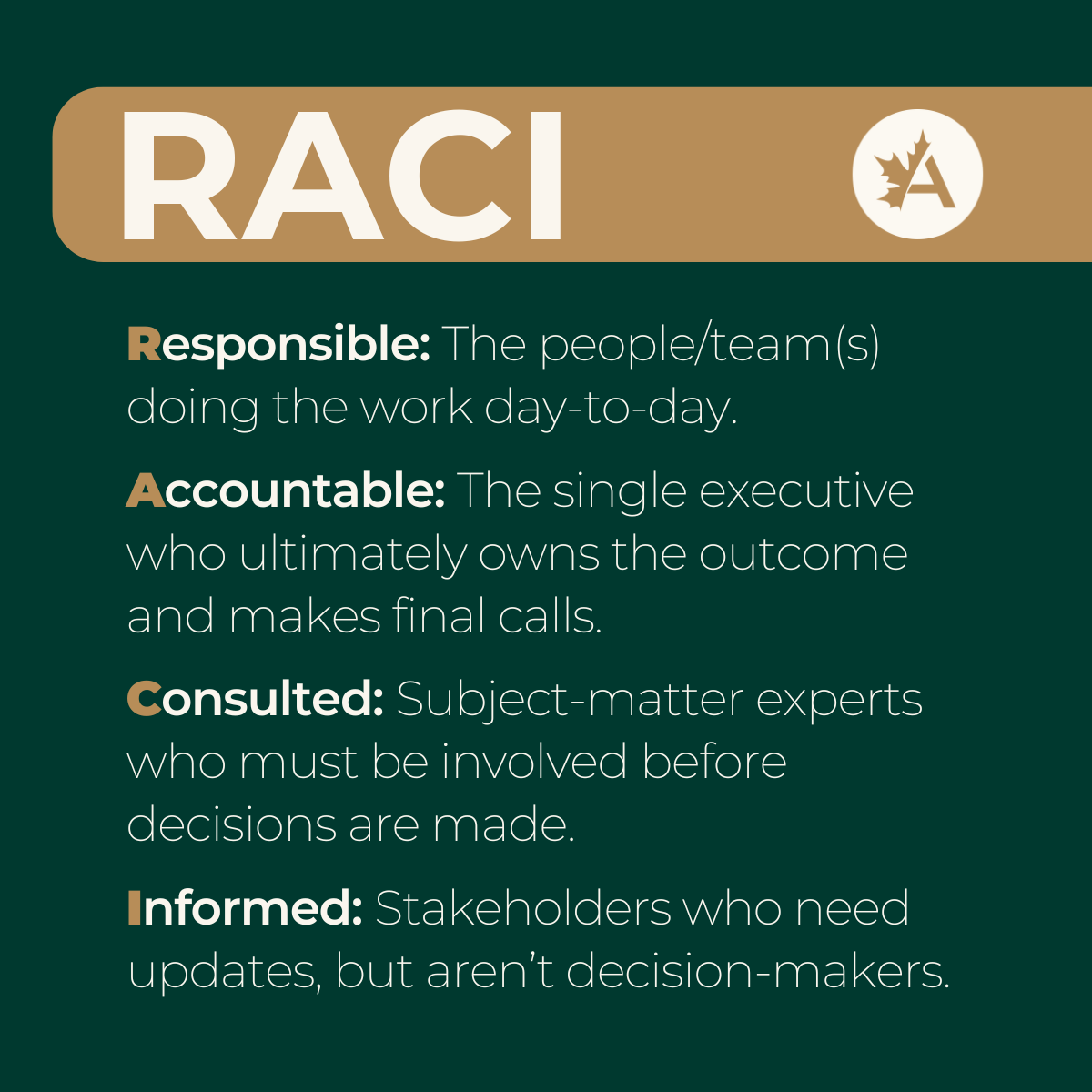

Executive ownership (RACI, not vibes)

Assign a clear executive owner (often COO / CRO / GC depending on the organization) and define cross-functional accountability across:

- Legal/Compliance (sanctions, export controls, contracting)

- Procurement/Supply Chain (concentration, substitution, route risk)

- IT/Security (threat posture, incident readiness)

- Finance/Treasury (liquidity, cost-of-capital sensitivity)

- Communications/HR (reputation, workforce impacts)

A real risk appetite statement

This is the difference between “we care about geopolitics” and “we can make decisions.” Examples of appetite thresholds:

- Maximum dependency on a single jurisdiction for critical inputs

- Maximum % revenue tied to politically volatile regions

- Tolerance thresholds for beneficial ownership opacity in counterparties

- Minimum continuity requirements for critical vendors (including cloud/SaaS)

A usable taxonomy (so you can measure it)

Instead of one bucket called “geopolitics,” define sub-risks with KRIs:

- Sanctions/countersanctions

- Export controls / technology restrictions

- Trade policy and customs disruption

- Data localization / digital sovereignty divergence

- Critical minerals and energy security constraints

- Cyber escalation aligned with geopolitical events

Link to the risks you already manage

Geopolitical drivers should be explicitly linked to:

- Operational interruption (delivery failure, delay, supplier outage)

- Compliance/Legal risk (ability to perform, pay, insure)

- Cyber risk (event likelihood and correlation)

- Financial risk (liquidity, margin compression, borrowing costs)

Why this matters in Canada: the Bank of Canada explicitly discusses scenarios where geopolitical escalation disrupts supply chains/commodity markets, raises inflation and leads markets to demand higher risk premiums; raising borrowing costs and weakening confidence. That’s not “strategy only;” that is an ERM channel.

Why scenario planning works better than forecasting for geopolitical risks

Geopolitical risk does not behave like a forecastable curve. It behaves like discontinuities — policy switches, enforcement changes and correlated cyber/supply shocks. So, the technical shift is from prediction to scenario architecture.

Build scenarios as decision tools

Your scenario set should include “families” that reflect how geopolitics actually hits operations:

- Trade escalation / tariff shock (fast policy changes, customs enforcement)

- Sanctions expansion (new listed entities, sector restrictions, payment friction)

- Export controls / tech restriction (licensing delays, prohibited transfers, vendor constraints)

- Cyber escalation aligned to conflict (disruption, influence, intelligence collection)

- Regulatory divergence (data localization/security requirements; procurement restrictions)

Standardize five outputs per scenario

If you want this to be operational (not academic), every scenario should produce:

- Exposure map: where you touch it (vendors, routes, customers, jurisdictions, systems)

- Impact pathways: how it becomes loss (delay, interruption, illegality, cyber incident, reputational shock)

- Decision triggers: what event changes your posture (new sanctions listing, export-control update, threat-level spike)

- Control posture: what you tighten immediately (approvals, routing, segmentation, supplier substitution, monitoring)

- Insurance implications: high-level assumptions on what might respond, what might have friction (learn more in part three)

The WEF’s “interconnected risks” framing is your justification for scenario architecture: once risks are correlated, you need structured decision readiness rather than one-dimensional forecasts.

Stress test supply chains for geopolitical risks

Supply chains should be tested as geopolitical systems, not just operational networks. This is where Canadian organizations can materially reduce tail risk.

Map tier dependencies (Tier 1–3 and “hidden concentration”)

- Identify Tier 1 suppliers for critical inputs

- Where feasible, map Tier 2–3 concentration (same region, same upstream producer, same chokepoint)

- Flag “single points of geopolitical failure” (jurisdictional or route concentration)

Reverse stress test (start with failure)

Instead of asking “how likely is a disruption,” ask: “What geopolitical event would cause us to fail to deliver within 15/30/60/90 days?” Then work backward to determine minimum resilience measures:

- Secondary suppliers approved and contract-ready

- Route alternatives pre-negotiated

- Minimum buffer inventory for strategic inputs

- Pre-approved substitutions and engineering alternatives

- Clear customer communication protocols

Contract engineering (contracts are resilience tools)

Build clauses that support survivability:

- Substitution rights for critical inputs

- Sanctions/export-control representations and termination triggers

- Force majeure language aligned to realistic disruption patterns

- Vendor continuity and notification obligations

The OECD’s work on geopolitical risks and trade resilience supports the idea that resilience has become a structural requirement as trade faces disruption and fragmentation pressures.

Integrate cyber risk with geopolitical intelligence

Cyber is now one of the cleanest channels through which geopolitical competition expresses itself in the private sector. Canada’s National Cyber Threat Assessment 2025–2026 describes a threat environment affecting Canadian organizations involving both state and non-state actors and emphasizes evolving risks to critical infrastructure and broader targets.

A geopolitically mature cyber program adds four components

Geopolitical threat triggers into cyber posture

- Define what events raise your threat level (sanctions escalation, conflict events, diplomatic flashpoints)

- Pre-map what changes operationally when threat levels rise (monitoring, access controls, vendor restrictions)

Scenario-based simulations (not generic tabletop exercises)

Run simulations that assume:

- Timing aligned with geopolitical escalation

- Simultaneous vendor outage or supply disruption

- Pressure on communications and executive decision-making

Cross-functional crisis response

Cyber response must integrate legal, communications, operations and leadership, especially if there are regulatory notifications, contractual obligations or reputational narratives to manage.

Insurance alignment

At this stage, the principle is simple: if cyber events are more correlated with geopolitical conditions, you should align incident response planning with policy wording realities and exclusions.

Allianz continues to rank cyber incidents as the top business risk globally in 2026, reinforcing how central cyber has become to enterprise risk posture.

Establish continuous trade, sanctions and regulatory monitoring

Trade and regulatory environments are no longer stable enough for periodic review. Continuous monitoring is now a controls issue.

What continuous monitoring looks like in practice

- Sanctions and export-control monitoring with defined escalation paths.

- Periodic counterparty screening (including beneficial ownership where possible).

- Vendor and customer onboarding controls that include jurisdictional exposure checks.

- Engagement with trade counsel and industry associations (especially for exporters).

- Financial modeling that includes policy volatility (tariffs, duties, delays, denied transactions).

For Canadian organizations, this is not optional “red tape.” It’s how you protect the ability to perform contracts and avoid compliance-triggered operational failure.

Elevate board and governance oversight on geopolitical risks

Boards increasingly expect management to articulate:

- How geopolitical risk affects strategy and operating resilience

- Where the organization is most exposed

- What controls and mitigation mechanisms exist

- How risk transfer aligns (and where it won’t)

Canadian regulators have been explicit that geopolitical tensions connect to integrity and security risks (including sanctions, cyberattacks, foreign interference and money laundering). OSFI’s risk outlook language underscores that these factors are not theoretical, they are supervisory and resilience priorities.

Practical governance mechanisms:

- Assign executive accountability and board-level oversight

- Include geopolitical scenarios in board education (brief, structured, decision-oriented)

- Require quarterly reporting on KRIs and scenario triggers

- Stress test decisions (what would we do if X happens next week?)

This is not risk aversion. It is fiduciary competence, especially when the risk can change your legal ability to operate, deliver or get paid.

Using insurance strategically for geopolitical risk

Insurance remains an important tool for geopolitical risk management, but it must be used with precision. In this series, part three will go deep on market realities, wordings and claims friction points. Here, the objective is strategic placement of risk transfer inside your broader resilience program.

Common risk transfer pillars that often connect to geopolitical pathways

- Political risk insurance (expropriation, political violence, contract frustration – where relevant/applicable)

- Trade credit insurance (counterparty non-payment, political risks affecting payment – structure dependent)

- Cyber insurance (incident response and loss pathways; alignment with policy wording matters)

- Directors and officers (D&O) liability (governance scrutiny, disclosure expectations, stakeholder actions)

- Contingent business interruption / supply chain (structure varies heavily; requires careful dependency mapping)

The key message: risk transfer should complement, not replace, operational resilience. In a correlated-risk world, the best “insurance outcome” is often preventing the event from turning into a cascading failure.

From awareness to advantage in a geopolitically fragmented world

Geopolitical volatility is not a passing phase. It is a defining operating condition, and it is increasingly measurable through the same channels ERM already manages: interruption, compliance friction, cyber events, capital pressure and governance expectations.

Canadian organizations that formally integrate geopolitical risk into ERM, scenario architecture, cyber resilience, supply-chain stress testing and board oversight will reduce downside exposure, but they’ll also demonstrate something underwriters, lenders and counterparties quietly reward: durability.

Resilience isn’t “defensive” anymore. It’s a strategic capability. And for the organizations that build it deliberately, it becomes a competitive signal in a fragmented world.

FAQs

Boards increasingly expect management to articulate:

- how geopolitical risk affects strategy and operating resilience

- where the organization is most exposed

- what controls and mitigation mechanisms exist

- how risk transfer aligns — and where it won’t

In practice, this looks like executive accountability, board-level oversight, quarterly reporting on KRIs and scenario triggers, and structured “what would we do if X happens next week?” stress tests.

Sometimes, but only with precision. Insurance can transfer specific geopolitical loss pathways (cyber incidents, D&O scrutiny, trade credit non-payment, political risk triggers, certain interruption structures), but it can’t replace operational resilience.

The goal isn’t “more insurance.” It’s aligning risk transfer to scenarios you actually face and recognizing where claims friction appears (wordings, triggers, exclusions, dependency mapping).

Risk transfer should complement resilience controls, because in a correlated-risk world, the best insurance outcome is preventing disruption from becoming cascading failure.

Integration is structural, not rhetorical. Treat geopolitics as an explicit ERM category with:

- executive ownership (RACI, not vibes)

- a real risk appetite statement

- a usable taxonomy with KRIs

- explicit links to risks you already manage (interruption, compliance friction, cyber correlation, financial/capital pressure, governance scrutiny)

Then replace “forecasting” with scenario architecture: build scenario families (tariff shock, sanctions expansion, export controls, cyber escalation, regulatory divergence) and standardize outputs (exposure map, impact pathways, triggers, control posture, insurance implications).

Share this article

Get weekly tips to protect your business!

Subscribe to our LinkedIn Newsletter. Our advisors’ insights will help you Be Risk Ready.

Aliya Daya, Senior Client Executive, specializes in risk management strategies and insurance solutions for the technology sector, as well as disruptive and emerging industries. With more than 25 years of experience in the insurance industry, Aliya serves as a Cyber Technical Specialist and National Mixed Practice Team Lead at Acera Insurance. She specializes in innovation, technology, cyber insurance and privacy breach, political risk, manufacturing / fabrication / wholesale / distribution, hospitality, non-profit and faith-based organizations.

You can reach Aliya at 403.717.5895 or aliya.daya@acera.ca

Related reading:

- Part 1: Geopolitical and business risk trends for 2026: A Canadian perspective

- Part 3: Risk transfer strategy for Canadian businesses facing geopolitical risks

Information and services provided by Acera Insurance, Acera Benefits and any other tradename and/or subsidiary or affiliate of Acera Insurance Services Ltd. (“Acera”), should not be considered legal, tax, or financial advice. While we strive to provide accurate and up-to-date information, we recommend consulting a qualified financial planner, lawyer, accountant, tax advisor or other professional for advice specific to your situation. Tax, employment, pension, disability and investment laws and regulations vary by jurisdiction and are subject to change. Acera is not responsible for any decisions made based on the information provided.

Get a quote.

Simply fill out a few details in our online form and one of our expert advisors will get your quote started.